Oasis: A ticketing debacle – and a tangled web of companies

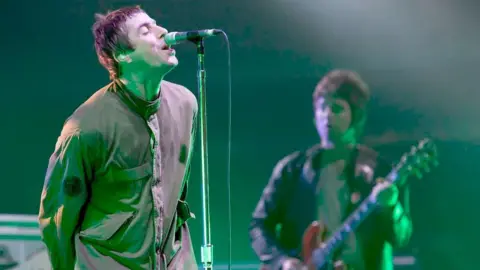

Getty Images

Getty ImagesOasis may never have anticipated that the scramble of hundreds of thousands to get their hands on tickets for their long-awaited comeback gigs would grab the attention of the British government.

The triggering of “dynamic pricing”, where prices of tickets were increased by more than £200 as demand soared, caused eruptions of anger among fans. And Culture Secretary Lisa Nandy said this week she wanted to ensure tickets were sold “at fair prices”.

Oasis said on Wednesday that the band did not know dynamic pricing would be used and had left pricing decisions up to promoters and management. The band announced additional dates and said these would be sold via an invitation-only ballot.

Ticketmaster, which says it is the world’s biggest entertainment ticketing platform and is one of three official sellers for the Oasis shows, said it did not set ticket pricing policy – artists and promoters did.

But the division is not as clear as Ticketmaster makes it sound. There are three promoters for the Oasis reunion tour, all with links to one company: Live Nation, the US multinational which owns Ticketmaster.

The promoters are Manchester-based SJM Concerts, MCD Promotions and DF Concerts.

SJM is almost wholly owned by Simon Moran and is one of the largest concert promoters in the UK. It also runs gigsandtours.com, one of the other official ticket sellers for the Oasis tour. (The third is See Tickets, which is owned by the German company CTS Eventim.)

SJM also has a joint venture with a subsidiary of Live Nation. And Mr Moran or SJM are listed as shareholders or directors of more than 10 subsidiaries of Live Nation.

They include one of the other Oasis gig promoters, DF Concerts – according to documents filed at Companies House, Mr Moran is a director and owns 20% of the shares.

The rest of the shares in DF Concerts are owned by… a Live Nation subsidiary.

Getty Images

Getty ImagesMeanwhile, MCD Productions merged with the same Live Nation subsidiary in 2019, a move which was investigated by the UK’s competitions regulator, but which was allowed to go ahead because it did not “raise competition concerns”.

Live Nation’s interests do not stop at promoters. It is involved in almost every aspect of the UK live music industry.

If, when you get to a gig, you head to the merch stall for a memento of a great night out – yes, you guessed it, Live Nation has interests in a number of merchandise companies too, including De-Lux Merchandising which makes official T-shirts, posters, books, hats and other merchandise that fans snap up.

Keeping you safe at that Oasis gig will be stewards and security. One of the biggest in the UK is Showsec – and yes, it is listed as a Live Nation subsidiary.

Live Nation also has interests in several venues. It owns and operates Cardiff Arena.

It also has a stake in the Academy Music Group, which has venues around the UK such as the O2 Academy Brixton, O2 Shepherds Bush Empire and the O2 Academy Glasgow. Simon Moran has a stake in the Academy Music Group too.

And Live Nation has a strand of its business called Artist Nation which “offers global touring deals and festival performances, as well as artist management”. Oasis are managed by Ignition Management, however, an independent company.

The festival season has just ended in the UK, and you would be correct to think that Live Nation owns a lot of those too, such as Creamfields Festival, Manchester’s Parklife and The Great Escape. Boomtown in Hampshire was one of the biggest independent UK festivals – until 2022, when Live Nation and SJM bought a minority stake.

Live Nation also owns promoters such as Festival Republic, which is the UK’s leading festival promoter responsible for Reading and Leeds, Wireless and Latitude festivals among others.

Getty Images

Getty ImagesSo is it good for consumers for one company to be involved in so many aspects of the UK’s live music?

The Competitions and Markets Authority (CMA), whose role is to promote competitive markets and protect people from unfair trading practices, confirmed it is “urgently reviewing recent developments in the ticketing market”.

“Consumer protection law requires businesses to be fair and transparent in their dealings with consumers, and businesses must give clear and accurate information about the price people have to pay. Failure to do so may breach the law,” a spokesperson said.

One reason companies may feel able to charge high, seemingly unfair, prices can be that they control a large share of the market. This can lead to the CMA also taking an interest under competition law rules – which say that if a company has a so-called dominant position, it must not abuse that in a way that harms consumers.

The CMA broadly says a company may be considered as having “dominant position” if it has a persistent market share of 40% or more.

At the time of Ticketmaster’s merger with Live Nation in 2010, the regulator estimated it had 40% to 50% of the UK market and Live Nation’s UK and Ireland chairman said this year that it is selling more tickets than ever.

Anneli Howard KC, competition and consumer barrister from Monckton Chambers, says lack of transparency, excessive prices or unfair selling conditions could result in legal action or regulatory investigations for “abuse of dominance” for such companies.

“There’s a heightened focus on breaches of consumer law or excessive pricing which we are increasingly seeing at the centre of damages actions in the English Courts – under competition law for abuse of dominance or under consumer law provisions,” she says.

The BBC has asked Live Nation, SJM and Ticketmaster for comment but they have not responded.

Getty Images

Getty ImagesLive Nation has already come under scrutiny in the US after Taylor Swift announced the Eras Tour in November 2022 and Ticketmaster’s website went into meltdown.

A Senate Judiciary Committee hearing was convened and for more than three hours Live Nation executives were grilled.

Last month, in an amended filing, 39 US states joined a lawsuit seeking monetary damages against Live Nation Entertainment and Ticketmaster over claims they have monopolised the entertainment industry.

The US Justice Department is also seeking to break up Live Nation, alleging it and concert promoters illegally inflated ticket prices and hurt artists.

In 2023, Ticketmaster says it scanned more than 4 million fans into events across the UK and Ireland, which they called a “historic high”.

Correction: A previous version of this article incorrectly stated that Live Nation owned the live music booking agency International Talent Booking (ITB). ITB has been an independent company since 2014.

Related

Why investing in women is a vital next step for…

Get Nadine White's Race Report newsletter for a fresh perspective on the week's newsGet our free newsletter from The Independent's Race CorrespondentGet our fre

Business secretary signals major shift on electric car policy to…

In a determined effort to retain Nissan’s manufacturing presence in Britain, Business Secretary Jonathan Reynolds has vowed to implement “substantial c

Joint Statement: Business Secretary and Fujitsu Services Ltd

Business and Trade Secretary Jonathan Reynolds today (Friday 7 March) met chiefs for Fujitsu in Tokyo to begin talks over the cost of redress for victims of th

UK foreign secretary backs multilateral defence funding for Europe

UK foreign secretary David Lammy has said that a new multilateral fund will be needed to secure Europe’s defence as he confirmed that Britain is “open to”