Energy price cap: People urged to read meter as bills rise

Getty Images

Getty ImagesBillpayers have been urged to give an accurate meter reading as gas and electricity price rises take effect.

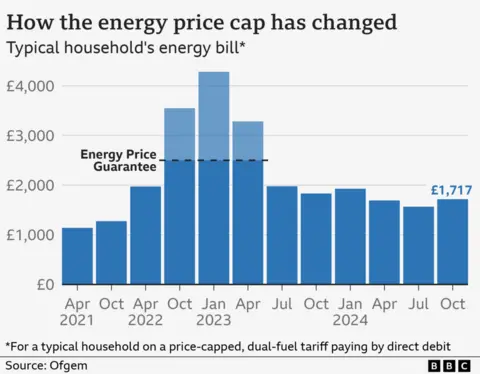

A household in England, Wales and Scotland using a typical amount of gas and electricity will now see their annual bill rise by about £149 to £1,717.

Experts have encouraged people to submit a meter reading as the change comes in so they can avoid being charged on estimated usage at the higher rate.

It comes as winter approaches without extra cost-of-living payments for those on low incomes, and as winter fuel payments are withdrawn for about 10 million pensioners.

Price cap changes

Energy prices for about 27 million homes in England, Wales and Scotland are governed by a price cap, calculated by the energy regulator Ofgem. It is set every three months and affects the price paid for each unit of gas and electricity.

Under the cap, prices have fallen twice this year – in April and July – but now, at the start of October, they have increased by about £12 a month for a typical user.

The final bill will depend on the amount of energy used, but to estimate the effect on annual costs, billpayers can add 10% to their current bill.

By reading their meters and submitting those to their supplier, price comparison website Uswitch says billpayers can avoid being charged in the short-term for energy they have not used, or having a bill based on an estimated reading at a higher rate. Those with operational smart meters have the reading taken automatically.

Standing charges have risen by one penny a day for gas and also for electricity, but the regulator is considering reforming the system.

The Utility Regulator in Northern Ireland says there will not be any price changes in October to the suppliers that it regulates.

The price cap is illustrated by Ofgem in terms of an annual bill for a household using a typical amount of gas and electricity. It affects those on default, variable tariffs, not those who have fixed a price for a set period.

That annual bill is lower than last winter, but charities say many people will struggle to cover the cost.

Some households have built up debt to their suppliers. Ofgem said nearly £3.7bn is owed collectively.

Steve Vaid, chief executive of the Money Advice Trust, the charity that runs National Debtline, said: “This only highlights what we have been saying for some time – without urgent support for households facing unaffordable arrears, energy debt will only rise further.”

James McMahon, from Blackburn, is slightly behind on his gas bill, which he said he was “not proud about” but unavoidable.

“[The price rise] is a big disappointment. You feel it inside,” he said.

“You can be big and proud and say I can manage, and make that bit of extra money. But when you take everything else we are being put through, it is just that bit too much.”

Some households will have less support because the final cost-of-living payment was made to eight million people on means-tested benefits in February.

For pensioners, the previously universal winter fuel payment, worth up to £300, will now be paid only to those on low incomes who receive certain benefits.

The payment is a devolved matter in Scotland and Northern Ireland and the Scottish government confirmed it will also no longer provide winter fuel payments to all pensioners.

While some previous recipients say they do not need it, charities and many MPs are concerned about pensioners still on a relatively small income who will miss out.

Forecasters have given some comfort with a change to their prediction for energy bills when the next cap comes into force in January.

Consultancy Cornwall Insight, which analyses the sector, has predicted a 1% fall in January to an annual bill of £1,697 for a household using a typical amount of energy.

Energy companies have said a voluntary initiative they have run in the last four years has identified vulnerable customers.

The sector’s trade body, Energy UK, said extra support totalling £500m had been given to those in need.

In specific terms, the latest change in prices means:

- Gas prices are capped at 6.24p per kilowatt hour (kWh), and electricity at 24.5p per kWh – up from 5.48p and 22.36p respectively. A typical household uses 2,700 kWh of electricity a year, and 11,500 kWh of gas

- Households on prepayment meters are paying slightly less than those on direct debit, with a typical bill of £1,669

- Those who pay their bills every three months by cash or cheque are paying more, with a typical bill of £1,829

- Standing charges – a fixed daily charge covering the costs of connecting to a supply – have gone up to 61p a day for electricity and 32p a day for gas, compared with 60p and 31p respectively, although they vary by region

How some pensioners can claim support

Hundreds of thousands of low-income pensioner households eligible for pension credit currently fail to claim it.

The government says it is worth an average of £3,900 a year and claiming it can qualify people for other financial support such as winter fuel payments.

You can check your eligibility for pension credit via the government’s online calculator.

Information is also available on how to make a claim. There is also a phone line available on weekdays – 0800 99 1234.

Guide to benefits, when you qualify and what to do if something goes wrong, are provided by the independent MoneyHelper website, backed by government.

Benefits calculators are also run by Policy in Practice, and charities Entitledto, and Turn2us.

Related

Why investing in women is a vital next step for…

Get Nadine White's Race Report newsletter for a fresh perspective on the week's newsGet our free newsletter from The Independent's Race CorrespondentGet our fre

Business secretary signals major shift on electric car policy to…

In a determined effort to retain Nissan’s manufacturing presence in Britain, Business Secretary Jonathan Reynolds has vowed to implement “substantial c

Joint Statement: Business Secretary and Fujitsu Services Ltd

Business and Trade Secretary Jonathan Reynolds today (Friday 7 March) met chiefs for Fujitsu in Tokyo to begin talks over the cost of redress for victims of th

UK foreign secretary backs multilateral defence funding for Europe

UK foreign secretary David Lammy has said that a new multilateral fund will be needed to secure Europe’s defence as he confirmed that Britain is “open to”