Donald Trump’s economic policies are extremely popular with voters and often what supporters cite when asked why they support the former president in his third bid for the White House. But economists beg to differ – and they’re begging the public to differ too.

On the surface, Trump’s vague plans to lower corporate taxes, extend his 2017 Tax Cuts and Jobs Act, implement tariffs on imported goods, eliminate taxes on tips and increase domestic employment opportunities sound appealing.

Though the former president has not released a comprehensive economic plan, he has consistently said he will lower costs for Americans and restore the nation’s finances back to a pre-pandemic era.

“My plan will bring back the American dream but bigger, better and stronger than ever before,” Trump touted during a rally in Michigan

It’s why in a Wall Street Journal poll of 750 registered voters, a vast majority of respondents said they’re in favor of Trump’s pitches. Even 47 percent said they supported imposing a tariff of up to 20 percent on goods.

But economists warn Trump’s policies could raise consumer prices, make the market less competitive, threaten the U.S.’s global standing, increase unemployment rates and slow growth.

In the same WSJ poll of 39 economists, the vast majority vehemently disagreed with some of Trump’s most popular policies.

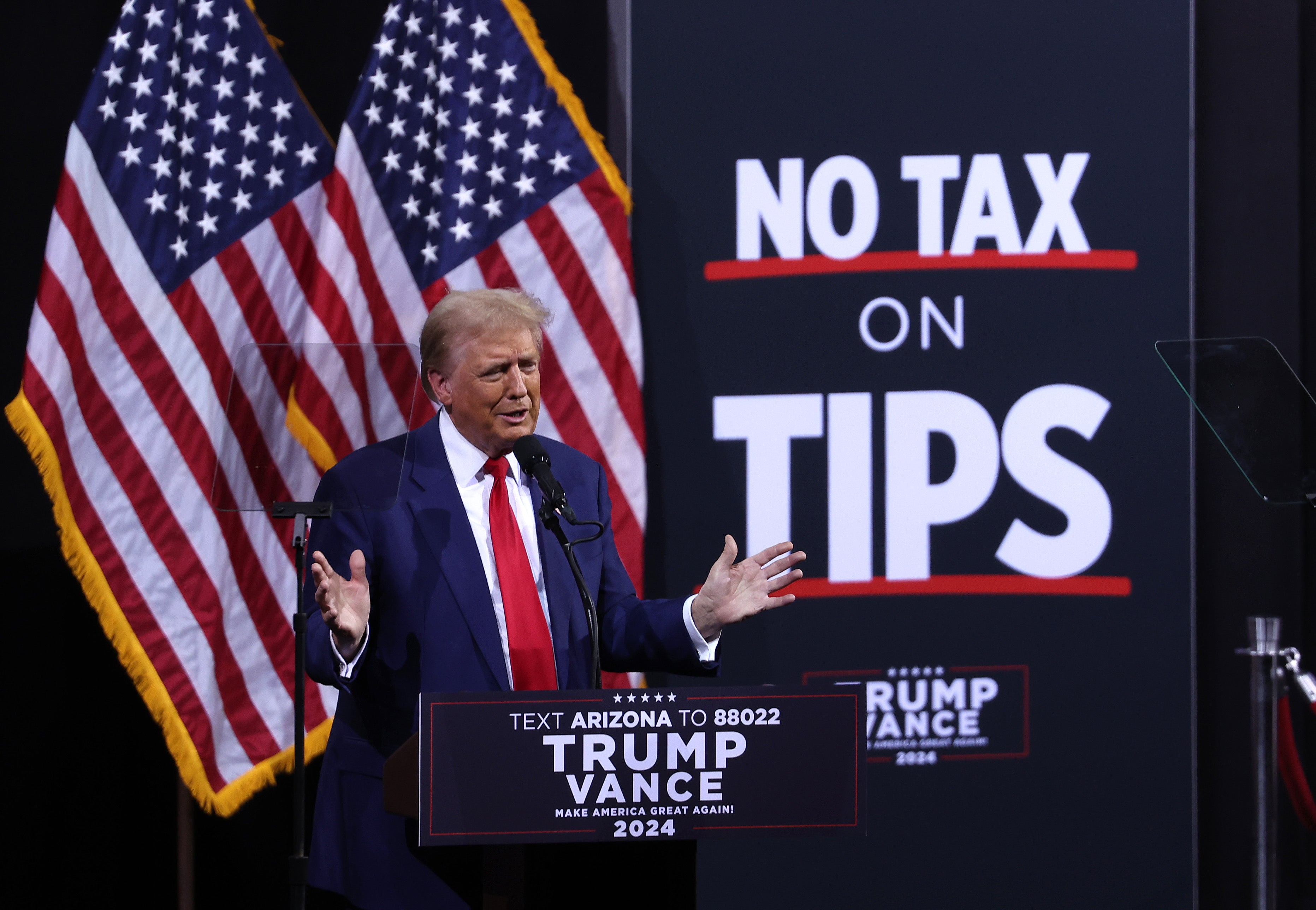

When it comes to eliminating taxes on tips, 87 percent oppose it, believing it would have little impact on lower-wage workers; 85 percent oppose extending, or making permanent, Trump’s 2017 tax cuts. One hundred percent oppose imposing tariffs on imported goods.

And sixteen Nobel prize-winning economists warned in an open letter that a second Trump term would have a “destabilizing effect” on the U.S.’s domestic economy and negatively impact its world standing.

An analysis from the Peterson Institute For International Economics found that Trump’s policies would “worsen American living standards.”

Eighty-eight current and former executives in corporate America predicted Trump’s policies “risk reigniting inflation” and would “lower GDP growth” and endorsed Vice President Kamala Harris in an open letter.

“As a bundle, the policies are pretty terrible,” Dr. Josh Bivens, a Chief Economist and Senior Researcher with the Economic Policy Institute said. “They will raise taxes on the vast majority of households on net while cutting taxes for the very rich and maintaining the tax cuts on corporations. They will create all sorts of weird unintended effects. No big problem currently facing US working families is really addressed.

“If they’re all undertaken, it is a near guarantee that the result would be higher interest rates and higher inflation,” Bivens said.

Yet despite all this, in a sign of the gulf between experts and the American public, Trump still holds a lead over Harris when it comes to the economy albeit slight.

Tax Breaks, Tax Breaks, Tax Breaks

The economy is the number one issue for voters across the political spectrum, regardless of age or gender, polling shows.

Over the last few years, Americans have been subject to record inflation, high interest rates and a widening wealth gap, among other issues. Much of this is due to the pandemic which stalled and tanked economies worldwide.

The former president claims he will enact sweeping tax cuts to multiple groups of people and expand his 2017 tax act, which largely benefitted corporations and wealthy individuals. He also said he would limit income tax on Social Security benefits and tipped or overtime wages and decrease the corporate tax rate from 21 percent to 15 percent.

“I think the American public is pretty tax-phobic in the abstract,” Bivens said. “Anything that promises a tax cut seems popular. Part of this is a lack of faith that any other policy might be able to deliver higher incomes for them, which is too bad.”

But the cost of enacting so many tax cuts will ultimately increase the country’s debt, economists say.

The Senate Committee on the Budget found that extending Trump’s 2017 tax cuts would add $4.6 trillion to the deficit.

“The Republican tax plan is to double down on Trump’s handouts to corporations and the wealthy, run the deficit into the stratosphere, and make it impossible to save Medicare and Social Security or help families with the cost of living in America,” Finance Committee Chairman Ron Wyden said in a press release.

Introducing: Tariffs

To balance massive tax cuts, Trump is proposing sweeping tariffs on imported goods of up to 10 percent and up to 60 percent on goods from China.

“I think the general support for tariffs is based on a view, not totally wrong, that trade policy has not generally been a big friend to US workers,” Bivens said.

Tara Sinclair, a Professor of Economics at George Washington University, described the former president’s economic approach as pro-business but not necessarily pro-market, stressing he employs a tactic of appealing to certain constituents.

Sinclair, who has spent the last two years working as an appointed Treasury official in the Biden–Harris administration, said most people hear the word “tariff” and assume it only impacts foreign countries but it can have the inverse impact.

“Tariffs would likely be a higher tax on consumers – U.S. consumers,” Sinclair said. “This idea that those tariffs would somehow be magically paid by the foreign companies and wouldn’t be passed through American consumers does not seem to stand out empircally in the data.”

Economists at the Tax Policy Center said this would “significantly” raise prices on goods that consumers would bear the brunt of. It could negatively impact inflation-adjusted domestic incomes and income tax revenues – something that could be offset by the Federal Reserve raising interest rates.

“When you put a tariff on something artificially, you’re going to make things more expensive, and if it’s an input, like steel for example, then you’re going to make the downstream companies that are using steel less competitive,” Steven Kaplan, an economist at the University of Chicago’s Booth School of Business, told WSJ.

Bivens said a more accurate way to describe the proposed tariff is just as a tax.

But a greater consequence could be its impact on global relations, potentially starting a trade war.

No Taxes on Tips

Eliminating taxes on tips is one of Trump’s most popular policies. Seventy-nine percent of people in the WSJ poll said they were in favor of it. However, economists warn that its negative impact outweighs its small positive impact.

“It might appeal to a small group of tipped workers. But in terms of thinking about tax fairness, in terms of thinking about the incentives for individuals to reformulate their compensation more in terms of tips, there’s a lot of potential issues there,” Sinclair said.

Bivens said exempting tips from taxation could have unintended effects, like lowering tipped workers’ eventual Social Security benefits.

Mass Deportation

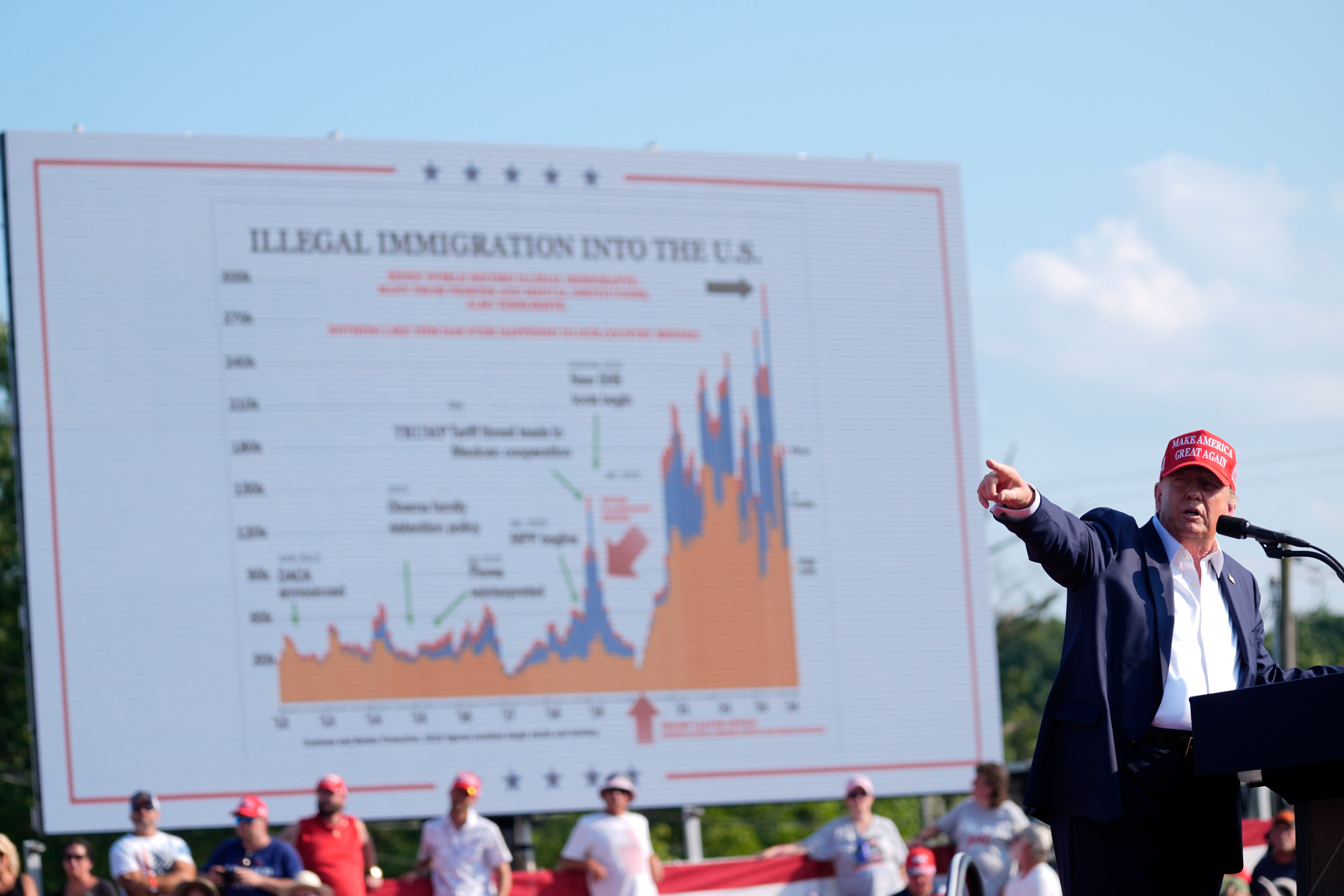

Perhaps the most striking economic policy is Trump’s desire to deport millions of migrants and immigrants – a policy that earns him roaring applause at his rallies.

“Blaming economic woes on foreign countries, foreign governments and immigrants…That appeals to human nature pretty well to be like ‘Ok these other people are responsible for economic woes’.” Sinclair said.

But she said the reality is that immigrants fill necessary job roles that Americans may not be willing to do or require specific skills, like fruit-picking or construction.

“A mass deportation event looks like it’s going to be very disruptive to our economy and therefore have serious costs,” Sinclair said.

Similarly, the Institute on Taxation and Economic Policy said 22 percent of American farmworkers, 15 percent of construction workers, eight percent of service workers, eight percent of manufacturing workers and six percent of transportation workers would be eliminated.

“The idea that deportation helps US citizens has always been an illusion. It’s never worked before and it wouldn’t work this time,” the ITEP said in an op-ed.

Perhaps it’s his reputation as a successful businessman that gives him an edge with voters or perhaps it’s his status as a former president, but many Trump supporters, or fiscally-conservative concerned voters, trust Trump to create a well-rounded economic plan.

But so far, the former president has not yet unveiled a plan that addresses voters’ top economic concerns. Instead, he has shared sound bites that appeal to specific groups of people.

“It makes me sad as an economic educator because I would really like people to understand more what it is that politicians can actually control,” Sinclair said.