Dollar and Bitcoin soar as Trump wins presidency

Getty Images

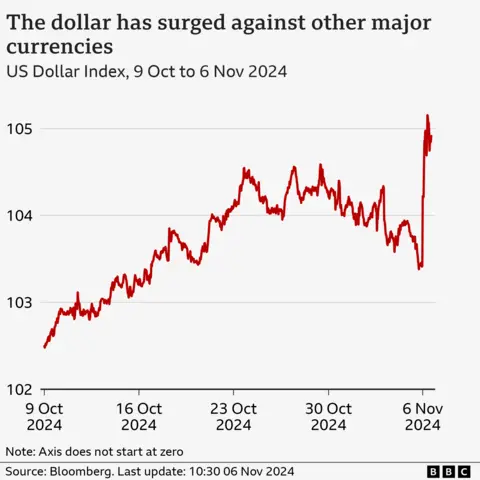

Getty ImagesThe US dollar has surged as Donald Trump is now projected to have won the presidency and will re-enter the White House.

Investors are betting that Trump’s plan to cut taxes and raise tariffs will push up inflation and reduce the pace of interest rate cuts.

Higher rates for longer mean investors will get better returns on savings and investments they hold in dollars.

Bitcoin has also hit a record high, following Trump’s election promise to make the US the “bitcoin and cryptocurrency capital of the world”.

Markets and currencies around the world have shifted sharply following the US election news:

- The FTSE 100 index, comprising the largest companies listed in the UK, was up 1% on Wednesday afternoon

- The pound sank 1.41% against the US dollar to its lowest level since August

- The euro dived 2.24% against the US dollar to its lowest level since June

- The dollar rose by about 1.4% against a host of different currencies, including the pound, euro and the Japanese yen

- In Japan, the benchmark Nikkei 225 stock index ended the session up by 2.6%, while Australia’s ASX 200 closed 0.8% higher

- In mainland China, the Shanghai Composite Index ended 0.1% lower, while Hong Kong’s Hang Seng was down by around 2.23%

- The major US stock indexes are expected to jump when trading opens

Why is Bitcoin going up?

The value of Bitcoin jumped by $6,000 (£4,645) to an all-time high of $75,371.69.

Trump’s stance on crypto is in stark contrast with that of the Biden administration, which has led a sweeping crackdown on crypto firms.

In the election campaign, Trump had suggested that he could fire Gary Gensler, the chair of US regulator the Securities and Exchange Commission, who has taken legal action against several crypto firms.

Trump has also said he plans to put billionaire Elon Musk in charge of an audit of governmental waste.

Mr Musk has long been a proponent of cryptocurrencies and his company Tesla famously invested $1.5bn in Bitcoin in 2021, although the price of the digital currency can be very volatile.

Tesla’s Frankfurt-listed shares rallied over 14% at the open on Wednesday. Mr Musk, Tesla’s top shareholder, has supported Trump throughout his electoral campaign.

Experts predicted a turbulent day elsewhere on financial markets, however, as a response to global uncertainty and Trump’s potential plans for the economy.

US bond yields, the return a government promises to pay buyers of its debts, also soared on Wednesday.

A bond is essentially an IOU that can be traded in the financial markets and governments often sell bonds to investors when they want to borrow money.

Analysts have suggested this could be down to traders expecting that some of Trump’s economic measures could lead to higher prices.

Donald Trump has said, for example, he would dramatically increase trade tariffs, especially on China, if he became the next US president.

Tariff impact

Some economists have warned that Trump’s proposals around trade would come as a “shock” to the UK economy.

Ahmet Kaya, principal economist for the National Institute of Economic and Social Research (Niesr), said it could be “one of the countries most affected” under such plans.

It estimates that economic growth in the UK would slow to 0.4% in 2025, down from a forecast of 1.2%.

Katrina Ell, director of economic research at Moody’s Analytics said: “Trump’s global trade policies are causing particular angst in Asia, given the strong protectionist platform on which more aggressive tariffs on imports into the US have been pledged.”

Trump’s more isolationist stance on foreign policy has also raised questions about his willingness to defend Taiwan against potential aggression from China.

The self-ruling island is a major producer of computer chips, which are crucial to the technology that drives the global economy.

Trump’s tax-cutting agenda has been broadly welcomed by large corporates in the US.

“We should see pro-business policies and tax cuts, in turn possibly driving up inflation and less rate cuts,” said Jun Bei Liu, portfolio manager at Tribeca Investment Partners.

Investors also have other key issues to focus on this week.

On Thursday, the US Federal Reserve is due to announce its latest decision on interest rates.

Comments from the head of the central bank, Jerome Powell, will be watched closely around the world.

Related

Why investing in women is a vital next step for…

Get Nadine White's Race Report newsletter for a fresh perspective on the week's newsGet our free newsletter from The Independent's Race CorrespondentGet our fre

Business secretary signals major shift on electric car policy to…

In a determined effort to retain Nissan’s manufacturing presence in Britain, Business Secretary Jonathan Reynolds has vowed to implement “substantial c

Joint Statement: Business Secretary and Fujitsu Services Ltd

Business and Trade Secretary Jonathan Reynolds today (Friday 7 March) met chiefs for Fujitsu in Tokyo to begin talks over the cost of redress for victims of th

UK foreign secretary backs multilateral defence funding for Europe

UK foreign secretary David Lammy has said that a new multilateral fund will be needed to secure Europe’s defence as he confirmed that Britain is “open to”