Bumper US interest rate cut aims to boost flagging economy

US interest rates have been slashed for the first time in more than four years – by more than many expected – amid fears the world’s largest economy is flagging.

The US central bank, the Federal Reserve, brought interest rates down by 0.5 percentage points to 4.75% to 5%.

Unlike the UK, the US interest rate is a range to guide lenders rather than a single percentage.

Read more: What next for interest rates?

Bringing down inflation to 2% is a primary goal of the Fed and it has used interest rates to draw money out of the economy by making borrowing more costly since 2022, when the Ukraine/Russia price shock hit.

Recent figures show the Fed is not far from its inflation target – with the main measure hitting 2.5% in August, the lowest rate in three years.

But signs of a weakening economy emerged last month as data on job creation led to recession fears.

The Fed signalled in its statement that while it was confident on both the inflation and growth outlooks, a slowdown in the pace of hiring was a cause for concern.

Only one member of its rate-setting committee dissented on the 0.5 percentage point reduction. Financial market participants had been split on whether it would go for the 0.25 option instead.

US stocks rallied in the wake of the decision, with the Dow Jones Industrial Average and broader S&P 500 both up by more than 0.5% from flat positions moments before the rate decision was revealed.

The dollar was trading a cent lower versus sterling at $1.32.

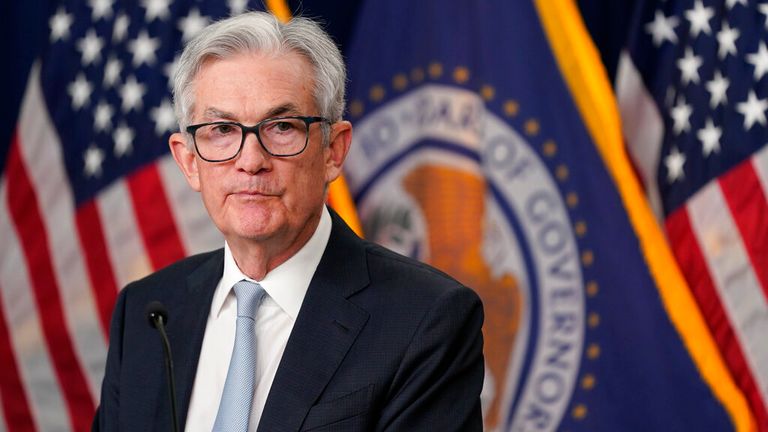

Some market analysts said the Fed’s move showed Fed chair Jay Powell and his fellow policymakers had been too slow to react to the employment slowdown.

He told reporters: “We’re going to be making decisions meeting by meeting, based on the incoming data and the evolving outlook, the balance of risks… it’s a process of recalibrating our policy stance away from where we had it a year ago, when inflation was high and unemployment low, to a place that’s more appropriate given where we are now and where we expect to be.

“That process will time time”, he added, saying there would be no “rush”.

Michael Sheehan, fund manager of fixed income at EdenTree Investment Management, said: “Kicking off this cutting cycle with a 50 basis point reduction will undoubtedly vindicate those who had argued that the Fed had fallen behind the curve.

“Any doubts that this cutting cycle would be any less dramatic than previous ones have been firmly laid to rest.

“We expect this larger cut of 50 basis points to boost risk assets in the short term. The key for markets, and indeed the Federal Reserve, will be how far the softening of the labour market has to run.

“Powell will be hoping that taking aggressive action early will go some way to curtailing a substantial weakening and achieve the elusive soft landing.”

What about the UK?

It comes as the UK central bank the Bank of England meets on Thursday to make its own interest rate decision.

While the Bank will focus on UK economic data – and on Wednesday afternoon was expected by markets to hold rates – it could be influenced by US decision-making.

Lower interest rates tend to weaken currencies, so a big cut from the Fed could be good news for the pound.

While being able to buy more dollars is good news for people holidaying in the US and paying for imports like oil, it’s bad news for exporters who get less for their goods as a result and have a less competitive product.

Lower exports can slow inflation, meaning the Bank could be more likely to cut.

Related

Why investing in women is a vital next step for…

Get Nadine White's Race Report newsletter for a fresh perspective on the week's newsGet our free newsletter from The Independent's Race CorrespondentGet our fre

Business secretary signals major shift on electric car policy to…

In a determined effort to retain Nissan’s manufacturing presence in Britain, Business Secretary Jonathan Reynolds has vowed to implement “substantial c

Joint Statement: Business Secretary and Fujitsu Services Ltd

Business and Trade Secretary Jonathan Reynolds today (Friday 7 March) met chiefs for Fujitsu in Tokyo to begin talks over the cost of redress for victims of th

UK foreign secretary backs multilateral defence funding for Europe

UK foreign secretary David Lammy has said that a new multilateral fund will be needed to secure Europe’s defence as he confirmed that Britain is “open to”