Week ahead – French and UK elections on the horizon, US jobs report eyed too [Video]

![Week ahead – French and UK elections on the horizon, US jobs report eyed too [Video] Week ahead – French and UK elections on the horizon, US jobs report eyed too [Video]](https://editorial.fxstreet.com/images/Macroeconomics/Countries/Europe/Eurozone_countries/France/eiffel-tower-during-spring-time-in-paris-france-40915096_Large.jpg)

-

France and UK go to the polls; will elections bring chaos or order?

-

US Payrolls report for June awaited as Fed hawks don’t budge.

-

Eurozone CPI, Fed minutes and ECB forum also on investors’ radar.

Macron’s gamble set to backfire

Political risks came back to haunt the euro in June as the resurgence in popularity for far-right parties sparked jitters in financial markets. France has been at the centre of this resurgence where Marine Le Pen’s National Rally party is on course to repeat its success in the European elections in the country’s legislative vote. The first round of the election takes place on Sunday, June 30, with the second round due a week later.

Most polls show that President Macron’s decision to call snap elections in the likely hope of forming a new coalition against the far right will not pay off. But markets are no longer as worried about a far-right government as they were in the immediate aftermath of the European election results. The National Rally party appears to have shifted towards the mainstream in its bid to appeal to more voters and secure an absolute majority, rowing back on some of its more radical pledges. It’s even said it will abide by the EU’s fiscal rules, which has been music to investors’ ears.

A bigger problem now for the markets is the possibility of the left-wing coalition leading the next government, which is more likely to spend recklessly and trigger a Liz Truss-style debt crisis. The left-wing alliance has overtaken Macron’s Ensemble coalition in the polls so should it come a close second after the National Rally, it could be in a position to form the next government.

Markets seem just as worried about the prospect of political paralysis in the event of a hung parliament. Even if the major parties were to put their differences aside and agree to a unity government to end a stalemate or keep the far right out of power, there is a danger that it may not survive long, hence the nervousness in the markets.

Will flash CPI boost ECB cut bets?

A strong showing for the National Rally could send the euro as well as French stocks and bonds lower on Monday in a knee jerk reaction before potentially rebounding, whereas a better-than-expected outcome for the other parties might initially be seen as positive before caution sets in.

Uncertainty about the French elections as well as concerns about political stability in other Eurozone countries has already started to weigh on business confidence and should that begin to hurt the growth outlook, the European Central Bank would be less likely to hesitate to cut interest rates again.

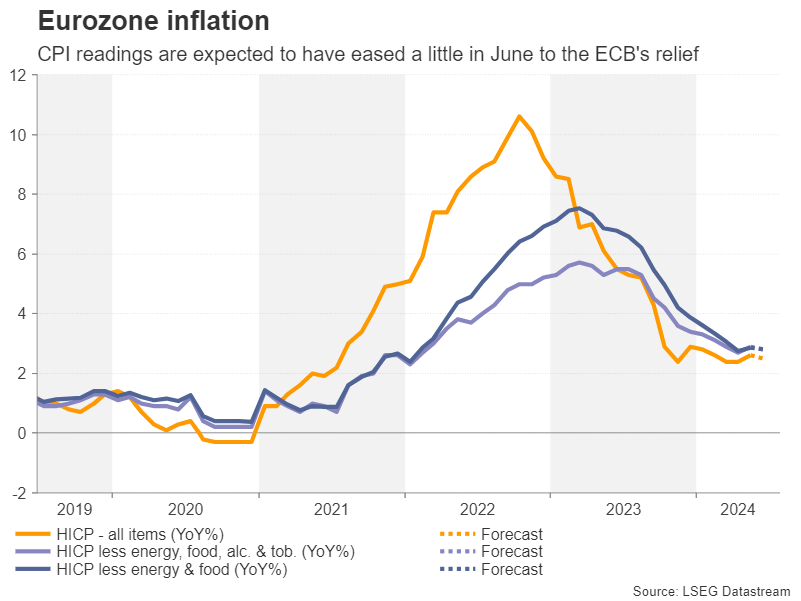

On that front, policymakers will be closely monitoring Tuesday’s flash CPI readings for the euro area following the surprise uptick in May in the headline figure to 2.6% y/y. The forecasts point to a small drop to 2.5% in June, which if confirmed, the euro could come under slight pressure as traders would raise their bets of a September cut.

But investors will be just as interested to hear what Lagarde & Co. will have to say on the price outlook during the three-day forum on central banking organized by the ECB in Sintra, Portugal. Fed officials, including Chair Powell will also be in attendance and take part in a panel discussion with President Lagarde on Tuesday.

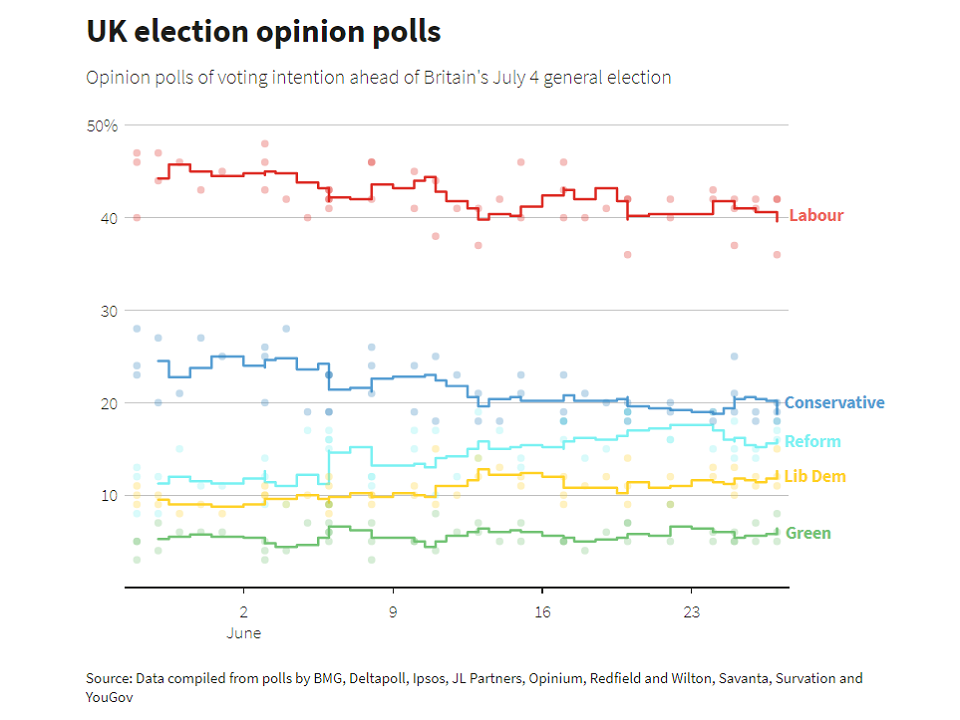

UK’s labour expected to win landslide

Across the Channel, there is less uncertainty surrounding the outcome of the UK general election on Thursday. Prime Minister Rishi Sunak has failed to turn the ruling Conservatives’ fortunes around despite a hard-fought campaign. The opposition Labour party are riding high in the opinion polls and could even win a supermajority.

As appealing as a stable government is for sterling right now given how tumultuous the past few years have been under the Tories, a weak opposition might worry some investors. There is a risk that the Conservatives might even be beaten to third place, losing out to Britain’s own far-right party, Reform UK, led by Brexiteer Nigel Farage.

However, it’s also possible that the Tories might do somewhat better than the polls suggest, giving Labour a narrower victory, and this could be positive for UK assets. But the real test for the pound will probably come after Keir Starmer has settled into Number 10 and the new finance minister, expected to be Rachel Reeves, has started to outline more details about Labour’s economic agenda.

Will NFP and ISM PMIs spoil the dollar’s bullish run?

With both the euro and pound gripped by domestic politics, investors are only slowly turning their attention to the upcoming US presidential election and monetary policy continues to be the dominant theme for the US dollar. The recent encouraging data on inflation as well as the signs of a slowdown in consumer spending and the housing market have bolstered hopes of a September rate cut by the Fed even though policymakers don’t yet seem convinced.

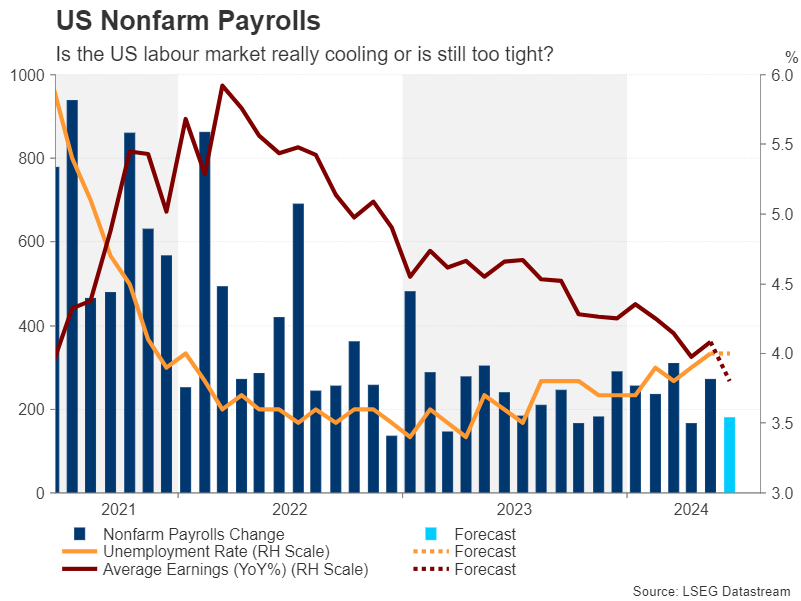

The ongoing tightness of the labour market is probably the main reason why the Fed is reluctant to drop its hawkish bias and Friday’s jobs report might not do much in changing that. Nonfarm payrolls are projected to have increased by 180k in June, which would be down from 272k in the prior month but still considered as a solid print.

The unemployment rate is forecast to have remained steady at 4.0% in June, while average hourly earnings are expected to have risen by 0.3% m/m versus 0.4% in May.

Ahead of the NFP release, there will be other gauges on the labour market, including the JOLTS job openings and Challenger layoffs on Tuesday, as well as the ADP employment report on Wednesday. In addition, the minutes of the June FOMC meeting will be published on Wednesday and may reveal more on policymakers’ thinking after most pencilled in just one cut for 2024 in the latest dot plot.

Should investors fail to get much clarity from the job indicators, they will focus more on the ISM PMIs. The manufacturing PMI is out on Monday and the services PMI follows on Wednesday.

The former is forecast to edge up to from 48.7 to 49.0, while the latter is expected to dip from 53.8 to 52.0. A weaker services PMI would be positive for Wall Street, as long as it doesn’t decline more than anticipated. But more importantly, markets will be hoping to see a deceleration in factory gate inflation.

The dollar is vulnerable to a selloff should the incoming data be broadly on the soft side following the steady gains over the past month.

Loonie and Kiwi on data watch ahead of July rate decisions

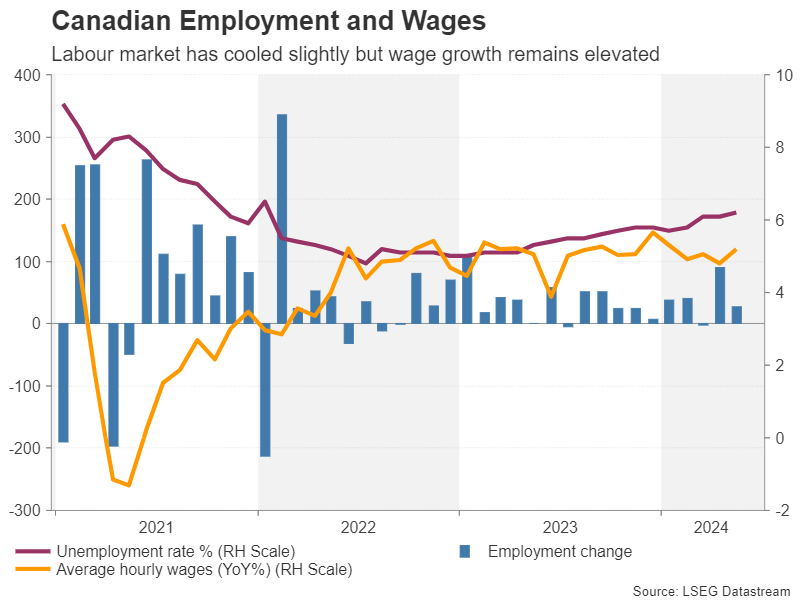

Canada will also see the release of jobs numbers on Friday, which could prove crucial for the Bank of Canada’s July policy decision. Expectations for a rate cut next month fell sharply after the hotter-than-expected May CPI figures. Wage growth is also a bit of a concern as it accelerated to 5.2% y/y in May. Any moderation in June could lift the odds of a back-to-back rate cut, pulling the Canadian dollar lower.

In the bigger picture, Canada’s labour market has been slowly cooling, with the jobless rate edging up from 2022’s post-pandemic lows, despite a healthy rise in employment.

In New Zealand, the kiwi will be keeping an eye on Tuesday’s NZIER business confidence gauge as the RBNZ’s next policy decision approaches on July 10, while its aussie cousin will be watching PMI numbers out of China.

The official manufacturing PMI due on Monday is expected to hold unchanged below 50 at 49.5 in June, but the Caixin equivalent is forecast to have eased slightly to 51.2.

Adding to Monday’s unusually busy start to the week is the Bank of Japan’s quarterly Tankan business survey. The outlook by businesses was likely little changed compared to the previous survey but which nevertheless doesn’t reflect the sluggish growth seen in the hard data. So, signs of ongoing optimism may offer the battered yen a supportive hand.

Related

Llyods Recruiting Engineers In India After Slashing Jobs In UK

Lloyds Banking Group is planning to hire hundreds of engineers in India as the company plans to shift its employment opportunit

Major new funding for music acts that supercharged careers of…

£1.6m Music Export Growth Scheme to support 58 independent UK artists to tour the world Funding will boost UK’s creative industries – a key growth se

Well-loved restaurant chain to close 8 venues across UK as…

A BELOVED restaurant chain has announced it will close eight venues across the UK, scrapping 158 jobs in the process.Owners are pointing the finger at Labour's

US adds 151,000 jobs in February as unemployment rate ticks…

The latest figures published by the US Bureau of Labor Statistics today (7 March) came in below market expectations, with economists polled by