Thames Water says it has enough cash until May next year

By Nick Edser, Business reporter, BBC News

Getty Images

Getty ImagesDebt-laden Thames Water has said it has enough cash to fund its operations until the end of May next year but that efforts to raise new money are continuing.

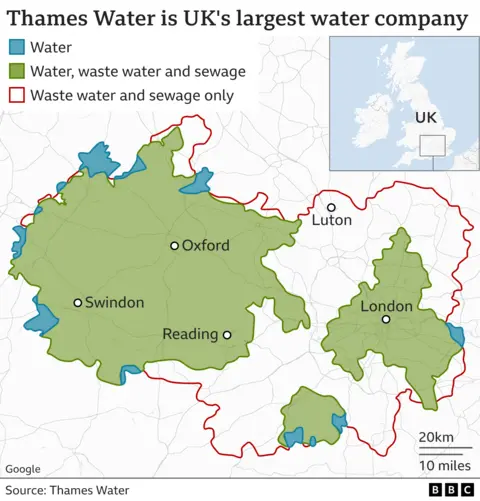

The UK’s largest water company, which is facing questions over whether it can survive, said its debts had risen to £15.2bn in the year to March.

Thames has also faced fierce criticism for its environmental record, and the company said the number of sewage discharges more than doubled last year.

Later this week, the water regulator Ofwat is due to publish its draft ruling on how much water companies can charge their customers for the next five years.

There has been speculation that Thames, which serves 16 million customers in London and the Thames Valley region, might have to be taken over by the government if it runs out of money.

The company says it has funding of £1.8bn, which is enough for it to keep going until May 2025.

Thames reported an increase in annual profits to £157.3m, but boss Chris Weston said the company was facing a difficult time, with strengthening its financial position “a critical priority”.

Thames wants Ofwat to let it raise consumer bills by up to 44% between 2025 and 2030, with extra money promised for investment in environmental measures.

On Thursday, the regulator will release its initial ruling on how much water companies can raise bills. There will then be several months of negotiations before a final ruling in December.

Thames said it would be talking to potential investors and lenders following Ofwat’s draft ruling, but it added this was not expected to be concluded until after the regulator’s final decision.

An earlier plan put forward by the company was rejected by the regulator, which led to questions over the firm’s future as shareholders at Thames’ parent firm, Kemble Water, subsequently withdrew a proposed cash injection into the company.

As well as its financial woes, Thames has also come in for steady criticism for the number of sewage discharges and water leaks affecting its customers.

Mr Weston, who joined Thames in January, said the company’s performance in this area was “not where it should be or where we want it to be”.

The number of sewage discharges rose to 16,990 last year from 8,015, which was put down to “prolonged heavy rainfall”.

The 40% increase in rain from the previous year also led to a rise in the number of reportable pollution events to 350 from 331.

However, Thames said it had reduced leakages by 7% to its lowest ever level.

‘Water quality is so important’

Marlene Lawrence is founder of swimming group, the Teddington Bluetits, in south-west London.

She says the group is concerned about water pollution in the River Thames and “swim mindfully”.

“I check [the water quality] daily,” she told BBC Breakfast.

The river is used by many different water groups, such as canoe clubs, which is why the quality of the water is so important, she says.

“People send their children to learn to row and to canoe and they won’t if they know the river quality is bad. This is so important.”

Thames’ results showed that it paid two dividends worth a total of £158.3m to two of its holding companies in March this year.

However, the company’s chief financial officer, Alastair Cochran, said the payments were for top-up payments to pension schemes, adding they were “entirely consistent with normal practice”.

In March this year, Mr Weston said it was “eventually possible” that the firm could be nationalised.

In Thames’ latest results, he said: “I continue to believe that a market-led solution that increases financial resilience is in the best interests of all stakeholders.”

However, he added this was “dependent on securing a final regulatory determination that is deliverable, financeable and investable, as well as affordable for our customers”.

Communities Minister Jim McMahon said on Tuesday there was “no programme of nationalisation for the water industry”.

However, he added there was “no provision in law for a water company to stop providing water”.

“We need to be very clear there is always a contingency in place.”

Mr McMahon added: “The days of putting shareholder interest above the national interest, frankly, can’t carry on and so we do need to look at that and Thames do need to look at their own house and get it in order.”

If Thames does come under government control, there has been speculation it would be put into a Special Administration Regime, which would see financial consultants run the company on the government’s behalf.

A precedent for this was set in 2021 when energy company Bulb went bust and was placed under special administration.

Regardless of what happens to Thames, water suppliers to its customers will continue as normal.

Related

Why investing in women is a vital next step for…

Get Nadine White's Race Report newsletter for a fresh perspective on the week's newsGet our free newsletter from The Independent's Race CorrespondentGet our fre

Business secretary signals major shift on electric car policy to…

In a determined effort to retain Nissan’s manufacturing presence in Britain, Business Secretary Jonathan Reynolds has vowed to implement “substantial c

Joint Statement: Business Secretary and Fujitsu Services Ltd

Business and Trade Secretary Jonathan Reynolds today (Friday 7 March) met chiefs for Fujitsu in Tokyo to begin talks over the cost of redress for victims of th

UK foreign secretary backs multilateral defence funding for Europe

UK foreign secretary David Lammy has said that a new multilateral fund will be needed to secure Europe’s defence as he confirmed that Britain is “open to”