Snail farm in Liverpool office sparks tax avoidance probe

BBC

BBCA city centre office building has been home to a snail farm for more than a year, in what council bosses allege is an attempt to avoid tax.

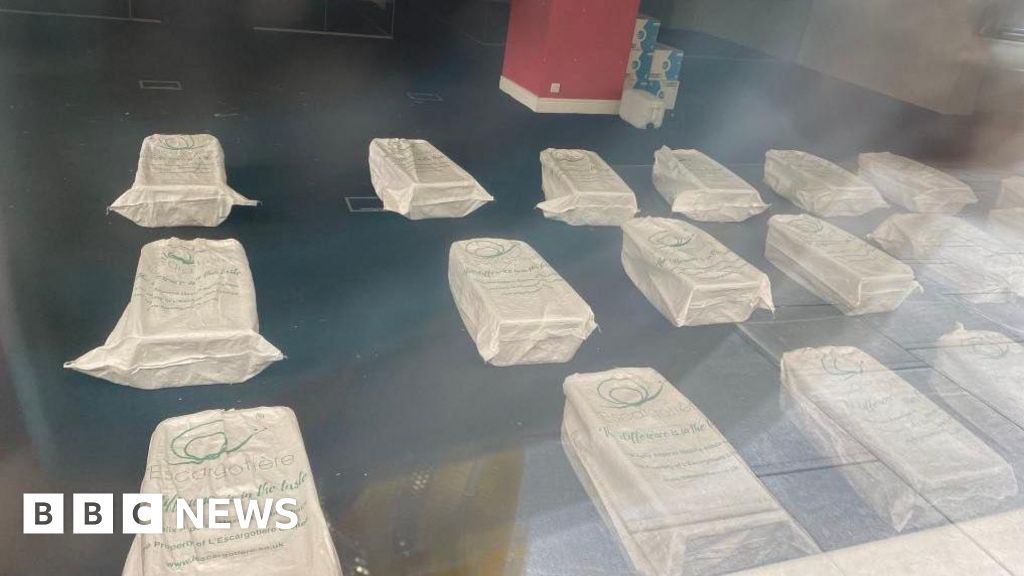

About 15 covered crates – containing as few as two snails each – have been kept on the lower ground floor of 9 Dale Street, in Liverpool, since 2023.

Under current law, this could qualify as “agricultural use” and this part of the building would arguably be exempt from business rates.

The firm renting the space said it was a legitimate snail farming operation.

The company, Snai1 Primary Products 2023 Ltd, shares its sole director, Terence Ball, with a company called BoyceBrook based in Ribchester, Lancashire.

BoyceBrook’s website says its team “has a proven track record of minimising the liability for empty property rates” and describes the company as the “Canceller of the Exchequer”.

In 2021, the High Court ruled that a snail farm tenancy deal between a landlord in Leeds and the management company Crusader, where Mr Ball was a director, was a “sham”.

‘Snail orgies’

Each crate contains two snails, according to L’Escargotiere, another company operated by Mr Ball, also based in Ribchester.

Its website says the number of snails per crate is kept to a minimum to avoid “cannibalism, group sex and snail orgies”.

Mr Ball – the son of the late North West shoe shop owner and local personality Tommy Ball – told BBC News that 15 crates containing two snails each could “create 1000 snail eggs, in the right environment”.

L’Escargotiere says it sells the snails in 1kg bags – the weight of about 200 snails – for £14 a bag.

Other snail farmers around the UK told BBC News they could not see how so few snails could make for a viable trade.

“You need thousands of snails, otherwise there’s no business,” one said.

Another said snail farming generally involved “feeding and cleaning daily”.

A representative of Mr Ball told the BBC that there are “regular, routine care procedures” and that the snails are “replaced every three to four weeks”.

The 2021 High Court ruling found that Crusader, also operated by Mr Ball, had “agreed to implement a scheme designed to achieve [the property owner’s business rates] avoidance objective”.

The owner of the buildings, Isle Investments, agreed to pay Crusader 20% of what the business rates would have cost them.

The Court of Appeal upheld the High Court ruling that the tenancies were “a sham”.

Tax avoidance is not a criminal offence, unlike tax evasion. It has been estimated that various schemes to minimise and avoid tax across the UK cost about £1.8bn in 2023.

Business rates are collected by councils and then redistributed by government to local authorities and used to pay for services.

The cost of rates for the building would normally be about £61,000 a year, but it is not known whether the snail farm lease is for the entire complex or just the lower ground floor.

Mr Ball did not respond to the council’s suggestion the snail farm was a tax avoidance scheme, but did say the firm had told the council and the Valuation Office Agency (VOA) when it rented the space and “provided full details of the current legislation required for exemption, which unfortunately is mostly ignored”.

British Virgin Islands

Land Registry records show the building was bought by Finchley Land Ltd for £5.4m in 2014.

The company is registered in Tortola in the British Virgin Islands, and its main shareholder is Iraqi businessman Namir El-Akabi, a construction and logistics tycoon involved in the rebuilding of Iraq after the fall of Saddam Hussein.

The BBC does not know whether Mr El-Kabi played any part in, or had knowledge of, the lease granted to Snai1 Primary Products 2023 Ltd.

Mr Ball did not respond to the BBC’s enquiry as to whether his firms received any payment for occupying the lower ground floor of the building.

The BBC has attempted to contact Mr El-Akabi for comment but has received no response.

A Liverpool City Council spokesman said: “The misuse of the agricultural exemption with the use of ‘snail farms’ in commercial premises is a business rates avoidance tactic that has been attempted in Liverpool.

“To date, no agricultural exemption has been awarded on commercial premises, and the Council’s Business Rates Team continues to monitor the situation closely and will not hesitate to take further action and challenge such tactics to protect public funds and maintain a fair and efficient tax system for all ratepayers.”

Related

Why investing in women is a vital next step for…

Get Nadine White's Race Report newsletter for a fresh perspective on the week's newsGet our free newsletter from The Independent's Race CorrespondentGet our fre

Business secretary signals major shift on electric car policy to…

In a determined effort to retain Nissan’s manufacturing presence in Britain, Business Secretary Jonathan Reynolds has vowed to implement “substantial c

Joint Statement: Business Secretary and Fujitsu Services Ltd

Business and Trade Secretary Jonathan Reynolds today (Friday 7 March) met chiefs for Fujitsu in Tokyo to begin talks over the cost of redress for victims of th

UK foreign secretary backs multilateral defence funding for Europe

UK foreign secretary David Lammy has said that a new multilateral fund will be needed to secure Europe’s defence as he confirmed that Britain is “open to”