Queen could sell their catalogue to Sony for $1bn

Mark Savage,Music Correspondent

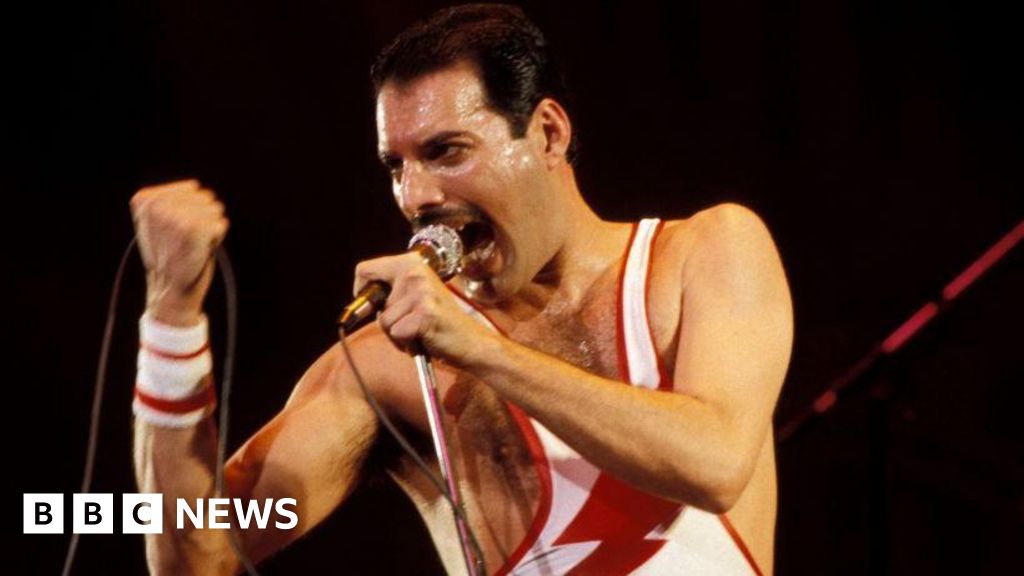

Getty Images

Getty ImagesSony Music is reportedly in talks to buy the music catalogue of the rock band Queen, including hits like Bohemian Rhapsody, Radio Ga Ga and Another One Bites The Dust.

According to Bloomberg, Sony is working with another investor on the transaction, which “could potentially total $1 billion” (£790 million).

The BBC understands that negotiations are still under way and may not result in a sale.

If it goes ahead, the deal would cover Queen’s songs and all related intellectual property – including the rights to logos, music videos, merchandise, publishing and other business opportunities.

Discussions over the sale have been taking place since last year.

Universal Music is also said to have been involved, owing to the company’s longstanding relationship with the band, who signed with the British label EMI in 1972 and remained with the company after it was bought by Universal in 2011.

If the group achieve the $1 billion price tag, it will be the biggest deal of its kind, surpassing the $500 million (£393 million) that Sony paid to acquire Bruce Springsteen’s catalogue in late 2021.

Earlier this year, Sony also acquired a 50% interest in Michael Jackson’s music from the late singer’s estate – at a cost of at least $600 million (£472 million).

Queen are more popular than either of those artists, with 52 million monthly listeners on Spotify – compared to 41 million for Jackson and 20 million for Springsteen.

That’s partly thanks to the success of the biopic Bohemian Rhapsody and the band’s ongoing tours with singer Adam Lambert, but mainly because songs like Crazy Little Thing Called Love and We Will Rock You remain globally popular and extremely lucrative.

In the UK, the first volume of Queen’s Greatest Hits is the most popular album of all time, with sales in excess of 7 million copies.

It was even the 20th-biggest seller of 2023, beating new releases by Ed Sheeran and the Rolling Stones.

According to its most recent financial statements, Queen Productions Ltd made $52 million (£42 million) in the year ending September 2022.

The proceeds are shared equally between guitarist Brian May, drummer Roger Taylor, bass player John Deacon and the estate of late singer Freddie Mercury.

Multi-million dollar deals

The sale of music catalogues has become a big business over the last eight years, with record labels and private equity companies snapping up the rights to music by David Bowie, Bob Dylan, Justin Bieber, Shakira, Neil Young, Blondie and Fleetwood Mac for multi-million dollar sums.

The deals provide immediate financial security to the artists and their estates, while the rights holders hope to profit by building new revenue streams for the music via film and TV licensing, merchandise, cover versions and performance royalties.

Music rights are seen as an attractive investment because songs continue to generate money for decades.

However, the business has seen some turmoil as rising interest rates undercut the long-term valuation of hit songs.

The investment fund Hipgnosis, which owns the rights to music by artists from Beyoncé to Barry Manilow, recently agreed to a $1.6bn takeover by the private equity firm Blackstone, after months of turmoil over the company’s governance and management structure.

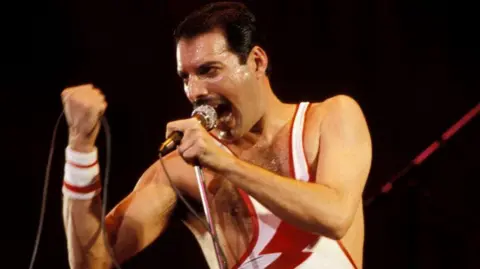

Getty Images

Getty ImagesDespite that, Queen’s catalogue is highly sought after, simply because of the longevity of their music.

Complicating the band’s potential deal is the fact that Disney Music Group owns Queen’s recorded music catalogue in North America.

The band own the rights for the rest of the world, and also retain the global publishing rights – the copyright for the music and lyrics.

The BBC has contacted Sony Music and representatives of Queen for comment.

Related

Why investing in women is a vital next step for…

Get Nadine White's Race Report newsletter for a fresh perspective on the week's newsGet our free newsletter from The Independent's Race CorrespondentGet our fre

Business secretary signals major shift on electric car policy to…

In a determined effort to retain Nissan’s manufacturing presence in Britain, Business Secretary Jonathan Reynolds has vowed to implement “substantial c

Joint Statement: Business Secretary and Fujitsu Services Ltd

Business and Trade Secretary Jonathan Reynolds today (Friday 7 March) met chiefs for Fujitsu in Tokyo to begin talks over the cost of redress for victims of th

UK foreign secretary backs multilateral defence funding for Europe

UK foreign secretary David Lammy has said that a new multilateral fund will be needed to secure Europe’s defence as he confirmed that Britain is “open to”