North’s private sector grew much faster than UK average during March, new survey suggests

The north’s economy improved significantly last month, an influential new business survey suggests.

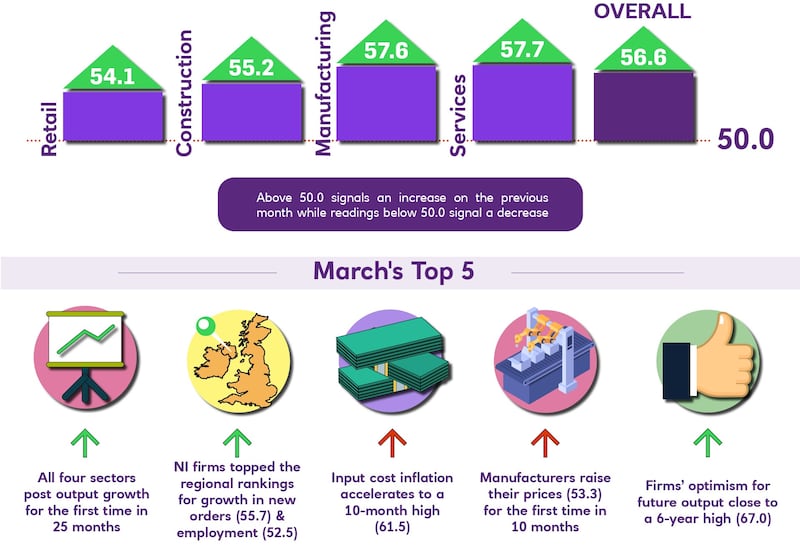

Ulster Bank’s purchasing managers’ index (PMI) indicates the rate of growth in the Northern Ireland private sector was faster than the UK average between February and March.

Official data published last month showed the north’s economy ended 2023 in decline, partly down to the performance of the public sector.

But the private sector has grown in each of the first three months of 2024, according to Ulster Bank’s PMI, and has picked up pace as the year progressed.

The latest monthly survey, published on Monday, suggests private sector output in Northern Ireland grew at the fastest pace for more than two years during March.

The PMI, which is based on the feedback from 200 construction, services, manufacturing and retail businesses, found March was the first time in 25 months that all four sectors recorded simultaneous growth.

The survey, which is carried out by S&P Global for Ulster Bank, said the responses pointed to a marked monthly expansion of business activity, with the growth detected in Northern Ireland much faster than the UK average.

The growth in output, new orders and employment all accelerated last month.

The survey also found also business optimism in the north at a six year high during March.

Manufacturers in particular were at their most optimistic since the survey began asking firms about their 12 month projections around seven years ago.

Ulster Bank’s chief economist said the March PMI was the first time in 33 months that all four sectors posted a pick-up in new orders.

“Encouragingly, as far as new orders and employment are concerned, Northern Ireland was the top performer amongst the 12 UK regions,” he said.

“On a less positive note, inflationary pressures and supply chain disruption intensified in March.

“Higher wages and increased shipping charges were cited as factors behind rising input costs, which reached a 10-month high.

“The acceleration in input costs was most apparent within construction and retail, with the latter passing these on to its customers by raising prices at their fastest rate in a year.

“On the other hand, services was the only sector to see input cost inflation ease.”

Mr Ramsey said the ongoing disruption in the Red Sea contributed to rising costs and lengthened supplier delivery times for the second month running.

But the challenges have not dampened business confidence, according to the survey.

“This is because the scale of these challenges is modest compared to what the private sector has experienced in recent years,” said the economist.

“Indeed, NI firms are their most optimistic about future output in nearly six years.

“All sectors still expect output to be higher in a year’s time, with manufacturing its most optimistic since the question was first asked seven years ago.”

Related

Why investing in women is a vital next step for…

Get Nadine White's Race Report newsletter for a fresh perspective on the week's newsGet our free newsletter from The Independent's Race CorrespondentGet our fre

Business secretary signals major shift on electric car policy to…

In a determined effort to retain Nissan’s manufacturing presence in Britain, Business Secretary Jonathan Reynolds has vowed to implement “substantial c

Joint Statement: Business Secretary and Fujitsu Services Ltd

Business and Trade Secretary Jonathan Reynolds today (Friday 7 March) met chiefs for Fujitsu in Tokyo to begin talks over the cost of redress for victims of th

UK foreign secretary backs multilateral defence funding for Europe

UK foreign secretary David Lammy has said that a new multilateral fund will be needed to secure Europe’s defence as he confirmed that Britain is “open to”