Over the last three months, four accounts on a popular gambling site have placed thousands of bets totalling more than $50 million on Donald Trump winning the US presidential election next week. The bets, placed on prediction platform Polymarket, appear to have skewed the odds massively in Trump’s favour on the site, with the total figure representing roughly 2 per cent of all bets placed on the 2024 elections.

The four accounts – Fredi9999, Theo4, PrincessCaro, and Michie – have been traced back to a single French national with “extensive trading experience and [a] financial services background”, according to a statement from Polymarket. The betting platform said there was no evidence that the trader had placed the bets to deliberately boost Trump’s odds, though the incident has proved how easy it is for one wealthy individual to manipulate the market.

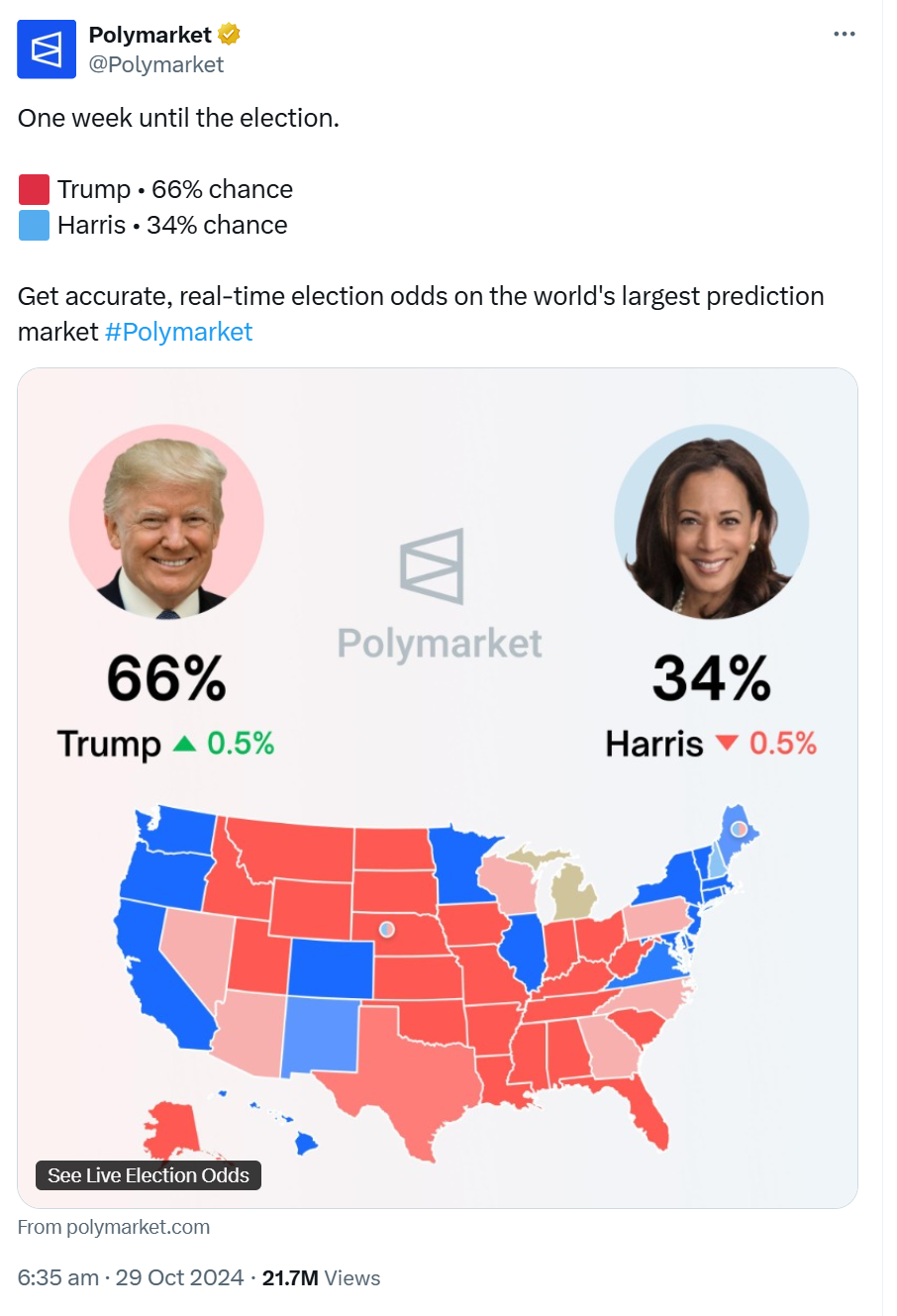

The latest figures from Polymarket give Trump a 66 per cent chance of beating Democratic rival Kamala Harris, who has just a one-in-three chance of taking the White House by these odds. Meanwhile, the latest national polling average compiled by FiveThirtyEight has a Trump victory at just 46.7 per cent and a Harris win at 48.1 per cent.

Some fear that Trump’s massively inflated betting odds could be used by his supporters as evidence that the election was stolen, while regulators have warned that gambling sites like Polymarket represent a significant threat to electoral integrity.

Many of Trump’s supporters are already sharing screenshots of the latest odds on social media as proof that victory is inevitable. Trump ally Elon Musk shared a screenshot on X of the Republican candidate’s growing lead in betting markets, claiming it was “more accurate than polls, as actual money is on the line”.

Conservative commentator Joe Kernen, who appears on CNBC’s Squawk Box, has frequently referred to the odds on-air and shared screenshots of Trump’s Polymarket odds on social media. Conversely, Democratic strategist Simon Rosenberg described the betting market odds as “Polymarket voodoo”, adding that “any analyst who takes it seriously should be ignored”.

Polymarket, which is backed by billionaire Trump-supporter Peter Thiel, allows people to bet on the outcome of future events using cryptocurrency. Currently only users outside the US are able to use it to bet on the US elections, though the semi-anonymous nature of cryptocurrency, combined with technologies like virtual private networks (VPNs), make it possible to bypass the platform’s terms of service.

Rules are also shifting to favour online gambling sites when it comes to elections in the US. Last month, a federal judge in the US overturned a ban on betting on election results in the country, which had been imposed by the Commodities Futures Trading Commission (CFTC).

Online betting markets have already placed TV ads during Trump rallies, with Kalshi offering viewers of Right Side Broadcasting Network $175 from a $100 bet on a victory for the Republican candidate. Popular trading platform Robinhood has also begun offering election bets this week, opening up the market to millions more potential voters.

The CFTC claims that election betting “ultimately commoditises and degrades the integrity of the uniquely American experience of participating in the democratic electoral process”, according to a statement put out in May by Rostin Behnam, chairman of the financial regulator.

Political figures have also warned of the potential dangers posed by online gambling sites when it comes to elections. In a letter to regulators last year, US Senators claimed that Polymarket and other gambling sites pose a “clear threat to our democracy”.

The letter, which was co-signed by prominent Democratic Senator Elizabeth Warren, argued that the “mass commodification” of the democratic process would fundamentally undermine its integrity.

“Introducing financial incentives into the elections process fundamentally changes the motivations behind each vote, potentially replacing political convictions with financial calculations,” the letter stated.

“For example, billionaires could expand their already outsized influence on politics by wagering extraordinary bets while simultaneously contributing to a specific candidate or party. There are strong ethics concerns as political insiders privy to non-public information could wield their inside information to profit at voters’ expense.

“Lastly, these bets could sway the outcome of our elections, undermining the voices of voters. If citizens believe that the democratic process is being influenced by those with financial stakes, it may further exacerbate the disenfranchisement and distrust of voters already facing our nation.”

New investigations by crypto research firms Chaos Labs and Inca Digital have found that Polymarket activity shows signs of market manipulation, with such trading forming around one third of all trading on the presidential elections.

The reports, first reported by Fortune, further call into question the accuracy of the site. The Independent has reached out to Polymarket for comment.

Writing on X last week, Polymarket founder Shayne Coplan described his creation as a “reality check” that extends far beyond the US elections.

“Hopefully politics is the first step to get the masses to realise the value of market-based forecasts,” he wrote.

“The market sets the price, not the operator. There is no ‘house’ setting the odds. It’s the invisible hand, not the thumb on the scale… As these markets get more popular, liquid, and accessible, we foresee a world where markets guide decision making, and opinions are backed by capital. The downstream effect is an information landscape with less sensationalism and more truth.”