Global Gambling Statistics 2025 – Worldwide Gambling Trends

Spanning continents and cultures, the allure of gambling has grown into a colossal market, shaping the fabric of societies around the globe.

While gambling was once relegated to back alleys and hidden games, recent years have found it becoming increasingly more common — and accepted. If anything, the ability to wager online has been like fuel to a fire, causing an unprecedented explosion in worldwide gambling.

This article aims to cut to the heart of the industry, exploring the top countries where gambling is not just mere entertainment but a significant economic force, as well as the trends and innovations that keep the market.

Growth in the Online Gambling Market

As much as we don’t want to mention it, the biggest force behind the growth of online gambling was the pandemic.

As post-pandemic restrictions began easing around the world, the global gambling industry market size already surged to an impressive 540.27 billion U.S. dollars in 2023.

Industry expectations are that 2024 will see upwards of $580.36 billion wagered thanks to emerging market growth, the influx of younger and female gamblers, and increased interest in online esports betting markets.

This is roughly a 16% increase from 2020’s $465.7 billion, and the growth of gambling doesn’t show any signs of stopping. In fact, it looks like we can expect a compound annual growth rate (CAGR) of around 7.5% through 2025, with the global online casino market reaching $674.7 billion by that time.

With roughly 60% of the world’s population, it’s unsurprising that the Asia-Pacific region accounts for the bulk of the online gambling market share, with 38.2% of the total market in 2020 (roughly $177.9 billion).

Asia-Pacific is followed swiftly by North America and Western Europe in terms of global gambling market size, though both regions have countries that hold enough market share to top the list of top individual countries in their own right.

What Contributed to This Growth?

As you might imagine, as the world was shutting down (even if only for a short while), many casino goers shifted towards online gambling platforms.

Several U.S. states — and countries around the world — relaxed their bans on online sports betting and casinos, leading to an influx of new players. Many of these bettors would previously have restricted their efforts to brick-and-mortar gambling establishments, while others may not have played at all.

There was also increased interest in offshore sportsbooks and casinos (platforms run from countries with lax gambling laws that accept players from the United States and other nations where betting might be forbidden).

The online casino market share has jumped from $16.6 billion in 2019 to $34.8 billion in 2023.

When you take into account all of the other online gambling options (sports betting, e-sports betting, online lottery, et cetera), the entire online gambling market is expected to reach $107.30 billion by the end of 2024, with a projected user penetration (percentage of the population using online gambling) to reach an astonishing 2.5%.

And it is not just pre-existing gamblers who jumped into online gambling during the pandemic. A recent survey by the UK Gambling Commission found that roughly 9% of young women who gambled started their betting journey during the shutdown — compared to 4% of all gamblers, with most of the gambling being done during this time on online gambling sites.

Key Takeaways

- The global online gambling market revenue surged to 540.27 billion U.S. dollars in 2023, with a 16% increase from 2020’s $465.7 billion.

- Based on expert forecasts, 2024 will see upwards of $580.36 billion wagered.

- The Asia-Pacific region accounts for the bulk of the online gambling market share (38.2%).

- The offshore casino market share jumped from $16.6 billion in 2019 to $34.8 billion in 2023.

- Based on a recent survey by the UK Gambling Commission, roughly 9% of young women started gambling during the pandemic.

Top 5 Countries in the Global Online Gambling Industry

| Country | 2023 Revenue | % Worldwide Revenue |

| United States | $66.52 billion | 12.31% |

| United Kingdom | $19.06 billion | 3.52% |

| Australia | $16.7 billion | 3.09% |

| Canada | $12.5 billion | 2.31% |

| Singapore | $4.91 billion | 0.77% |

| Rest of the World | $420.58 billion | 77.84% |

Now that we understand just how big the impact on the global economy is, let’s drill down further to get a clearer picture of what is actually going on on a country-by-country basis.

We will look at each of the top five countries for gambling revenue and market share and see if there are any valuable insights into how their populations engage with their country’s gambling industry.

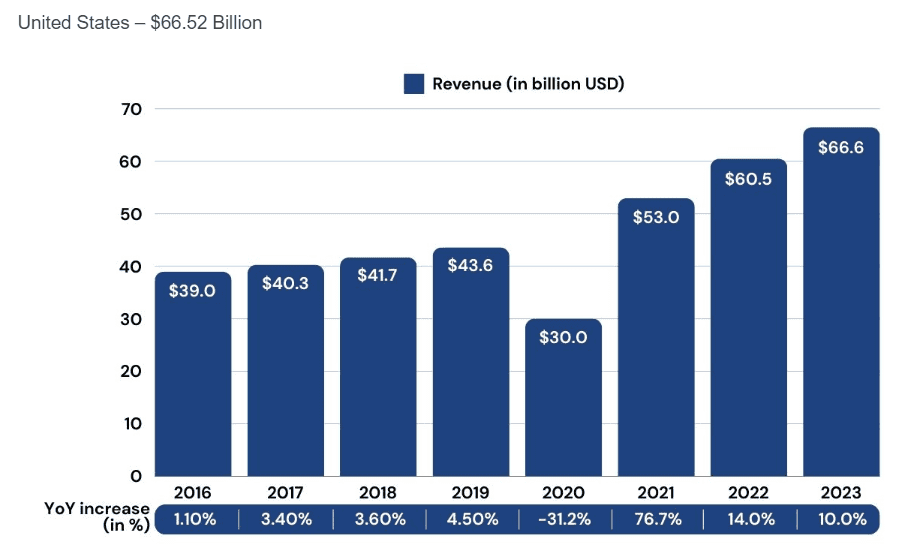

United States – $66.52 Billion

While 2022 was a blowout year for the United States, with over $60.46 billion for the full year (up 14% from the year before), with the last report released by the American Gaming Association, 2023 was shaping up to be even bigger.

From January to November 2023, the United States gambling market was sitting at $59.84 billion in total revenue, up 9.5% from the same months from the year before.

While most states featured significant increases in revenue — particularly Nebraska, which saw a 722.3% increase over the year before — other states saw a small dip when compared to the year before.

For example, Mississippi was down 3.8%, Indiana 3.1%, and Washington DC saw a dip of 20.2% compared to 2022.

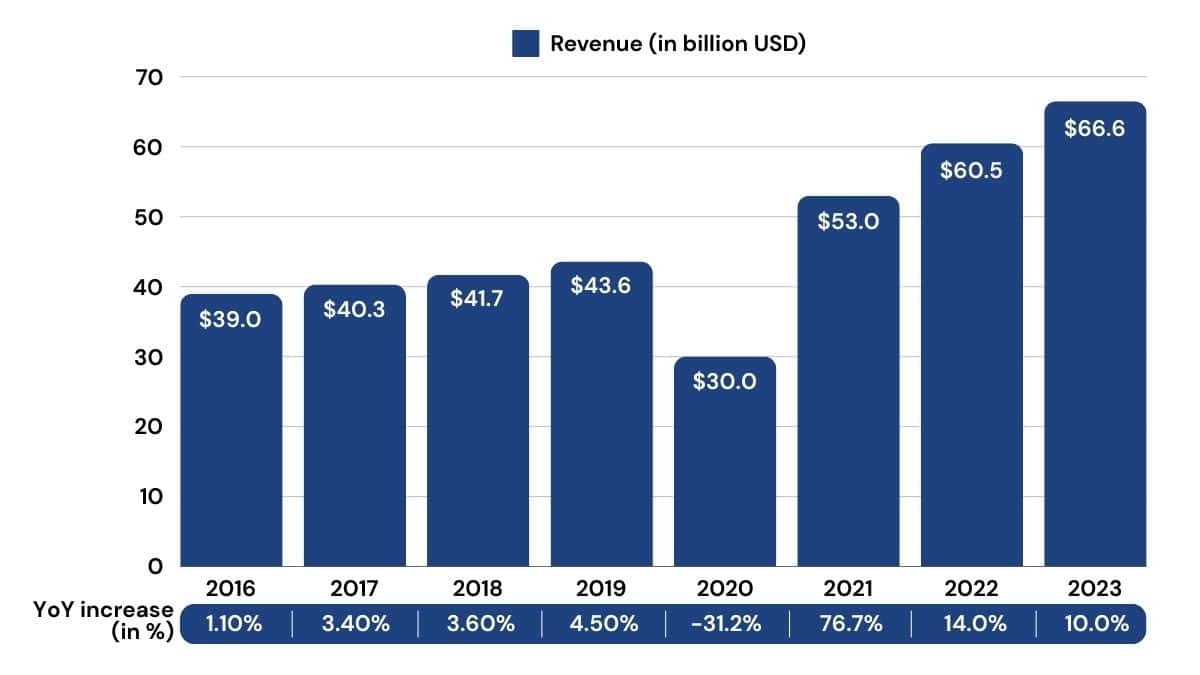

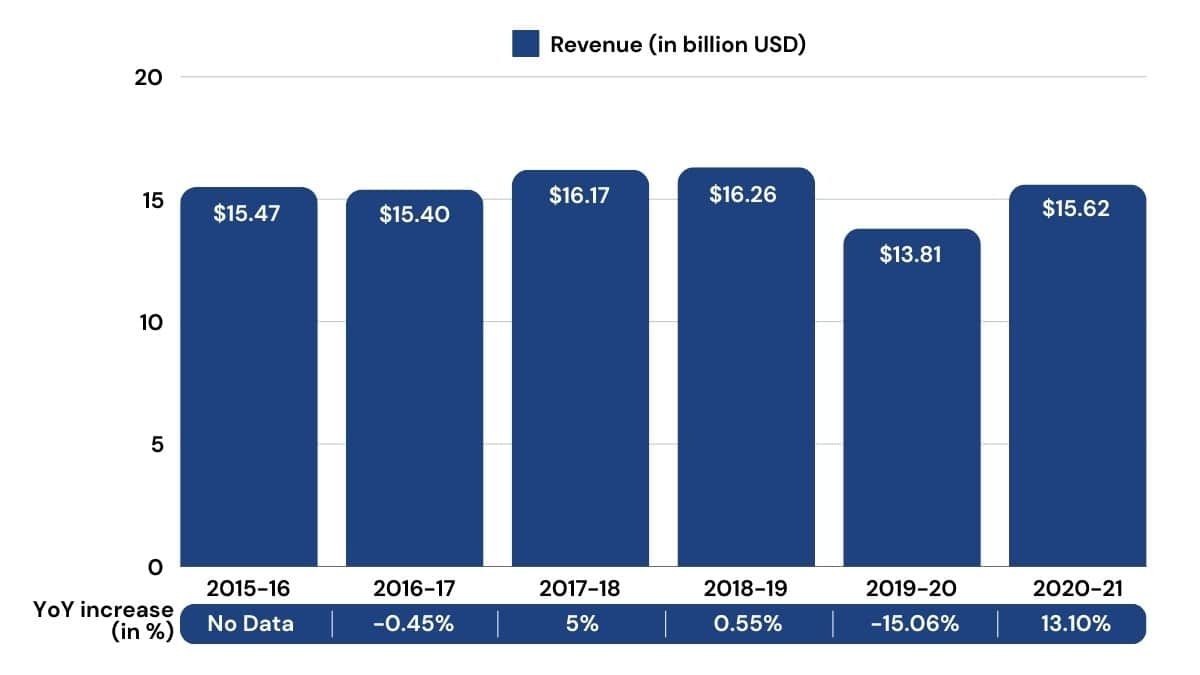

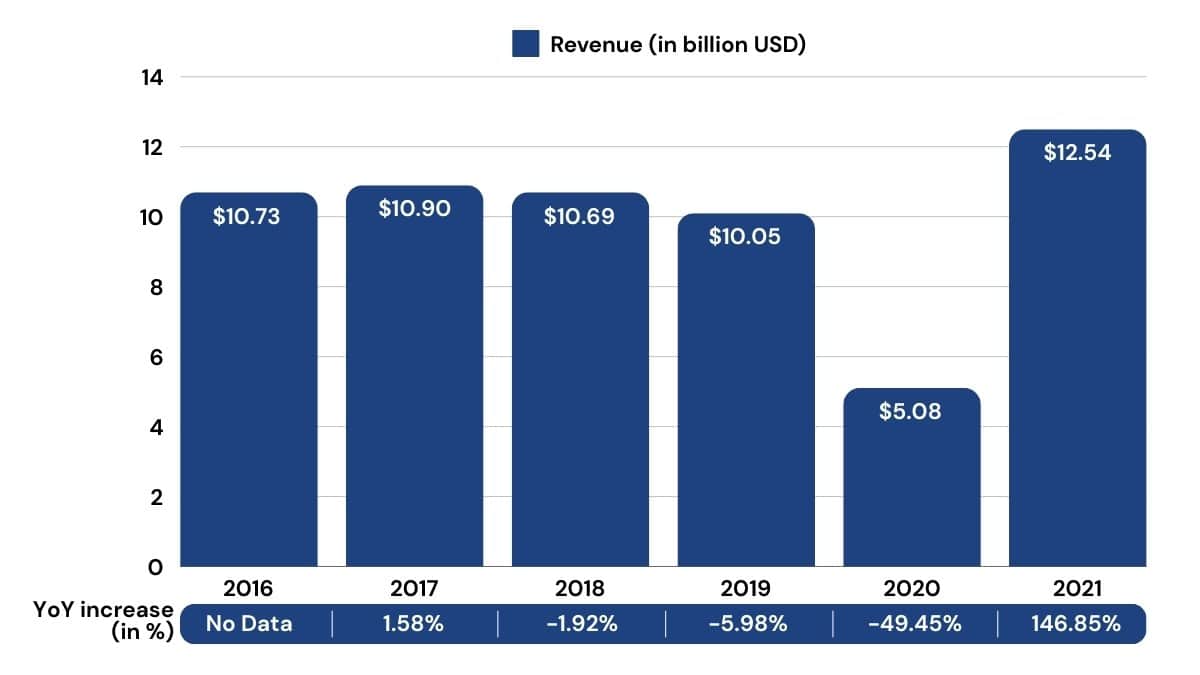

The UK – $19.06 Billion

It is estimated that 44% of the adult population participated in some form of gambling in 2023, with £14.1 billion (roughly $19.06 billion American) being generated.

That 44% is made up of Brits 16 and older, and a significant portion of that population (26% of all adults) used an online gambling platform.

Interestingly, this is a somewhat smaller percentage of the population than what participated pre-pandemic, as a study by the United Kingdom Gambling Commission showed that 47% of respondents aged 16 and up participated in 2019.

Similarly, the total GGY for the United Kingdom’s gambling market has also dropped from that time, with the 2018-2019 year representing a total of £14.32 billion.

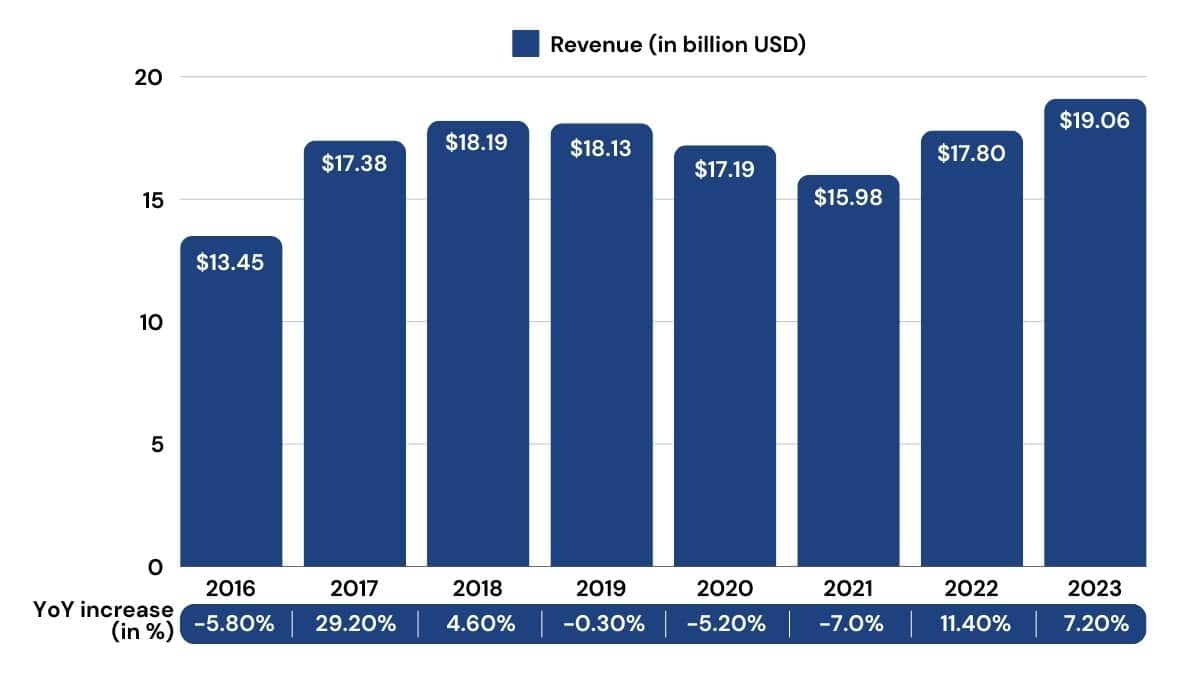

Australia – $16.7 Billion

Australia loves its gambling, particularly in the form of pokies (the local term for video slot machines), with individual players wagering about $1,093 per year, cementing itself as the third-highest gambling nation in the world back in 2018.

An estimated $25 billion AUD ($16.7 billion USD) is spent per year, making Australia the highest-spending country per capita, generating $6.6 billion in revenue for the state.

Canada – $12.5 Billion

Canada has proven to be another safe space for individuals loving the element of risk that gambling games afford. Nearly half of all Canadians view betting favorably enough that they agree it should be allowed (48%).

And though Canada was faced with a similar decline in market revenue, a combination of new and existing players taking up online gambling has caused a surge in the online market share since 2020.

In fact, the beginning of lockdowns saw up to 15% of the population gambling online compared to the 5% that played in 2018.

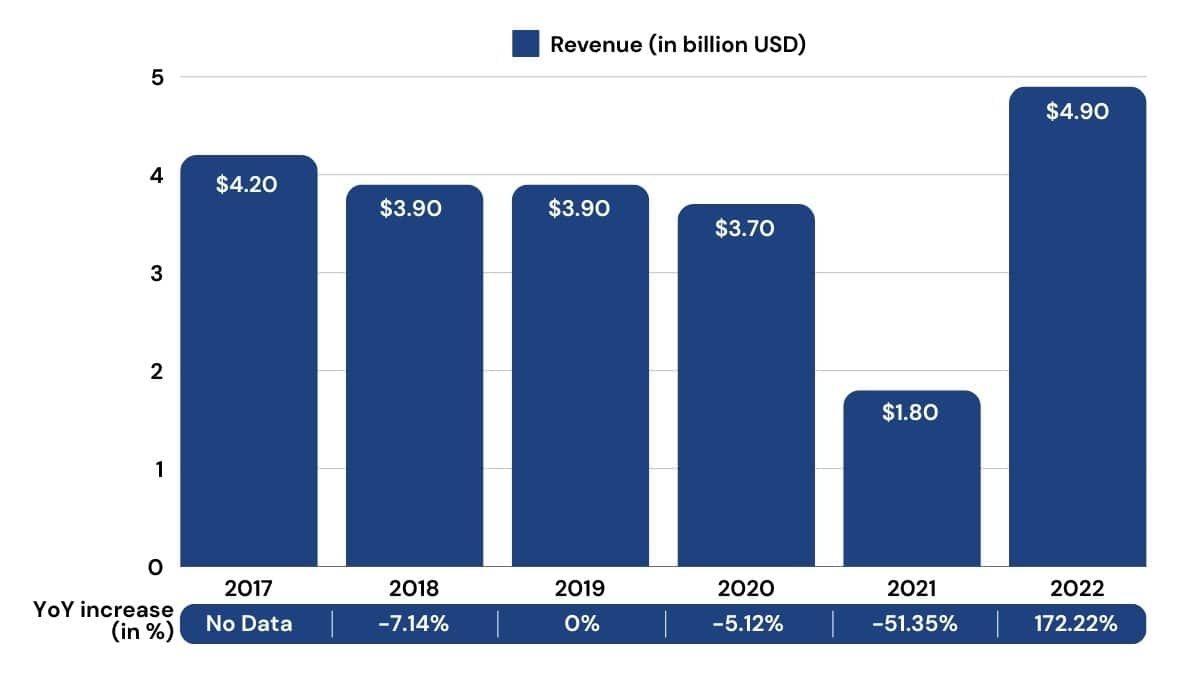

Singapore – $4.91 Billion

A recent addition to the top five global casino markets, Singapore recently beat out Macau’s $1.5 billion market share.

It is estimated that the average Singapore bettor spends $1,731 annually, which helped bring Singapore’s gambling revenue up from $1.8 to $2.5 billion for 2022 with a total Gross Gaming Revenue of $4.91 billion.

In a trend that lines up with other top countries, 44% of Singapore residents over the age of 18 participated in gambling back in 2019.

Other Countries of Note

Macau

Recently knocked out of the top five by Singapore, Macau’s casino and betting market is the only part of China where gambling is legal — making it a hot destination for Chinese players looking to do any sort of legalized gambling.

Ireland

Ireland has a strong history of gambling, making up 2.6% of Europe’s gambling market revenue, even though it consists of only 1.1% of the population.

A large part of this seems to be due to what many consider to be exceedingly lax regulation around online gambling and the marketing of such… though steps are being made to reduce the prevalence of gambling ads.

For example, a 2022 bill was introduced to require consumers to “opt-in” to receiving gambling advertisements rather than having these sorts of marketing materials just… showing up. Whether or not these steps are working remains to be seen, as there is a projected 2.53% growth over the next few years.

Key Takeaways

- Gambling in the US leads the industry with a $59.84 billion revenue.

- Sports betting in the US is the main force behind the huge revenue, with an increase from $4.34 billion in 2021 to $7.5 billion in 2022.

- 44% of the UK’s population has participated in some form of online gambling in 2023.

- £14.1 billion (roughly $17.75 billion American dollars) of gambling revenue was generated in the UK in 2022.

- Australia leads the way for wagering per capita, with individual players wagering about $1,093 per year.

- Over 48% of Canadians think online betting should become legal in the entire country.

- Singapore knocks Macau out of the 5th position with a $1.5 billion market share and $4.91 billion being wagered.

- Ireland makes up 2.6% of Europe’s gambling market revenue.

What Do the Top Countries Gamble On the Most?

Now that we know who the biggest players are, its time to dive deeper into just what those numbers mean — and one of the best ways we can do that is look at what each country’s citizens are playing.

United States – Slots

In both 2022 and 2023, traditional brick-and-mortar casinos and gambling halls still dominated the scene, with both iGaming and sports betting seeing astonishing growth.

Sports betting revenue increased from $4.34 billion in 2021 to $7.5 billion in 2022, with Americans placing over $93 billion in sports wagers throughout the year — the biggest cause of this being Louisiana, Maryland, and New York legalizing mobile betting while Kansas finally opened itself up to sports betting in general.

In fact, it looks like opening up these additional betting avenues has made a massive impact, as New York has become the country’s largest state for sports betting. New York residents placed a total of $16.7 billion in wagers through mobile betting platforms, generating $1.4 billion across the state.

However, if we look beyond simple sports betting in the US, it’s no surprise that Nevada, home to the almost-mythical Las Vegas, is the #1 state for gambling, generating $14.84 billion in gross gaming revenue in 2022. Nevada is followed distantly by Pennsylvania and New Jersey with $5.3 and $5.2 billion, respectively.

While we’re waiting for updated casino statistics on 2023’s Q4 revenue, we can look to 2022 to see that American players heavily favor slot machines. Over $34 billion of the $60.42 billion in gross gaming revenue consists of video slot games, while $10 billion was generated at the tables, and $7.5 billion for sports betting nationally.

This leaves online gambling (iGaming) with the last $5.02 billion — an increase of 35.2% over the year before, proving that even with things opening up, American players continue to rush toward online platforms.

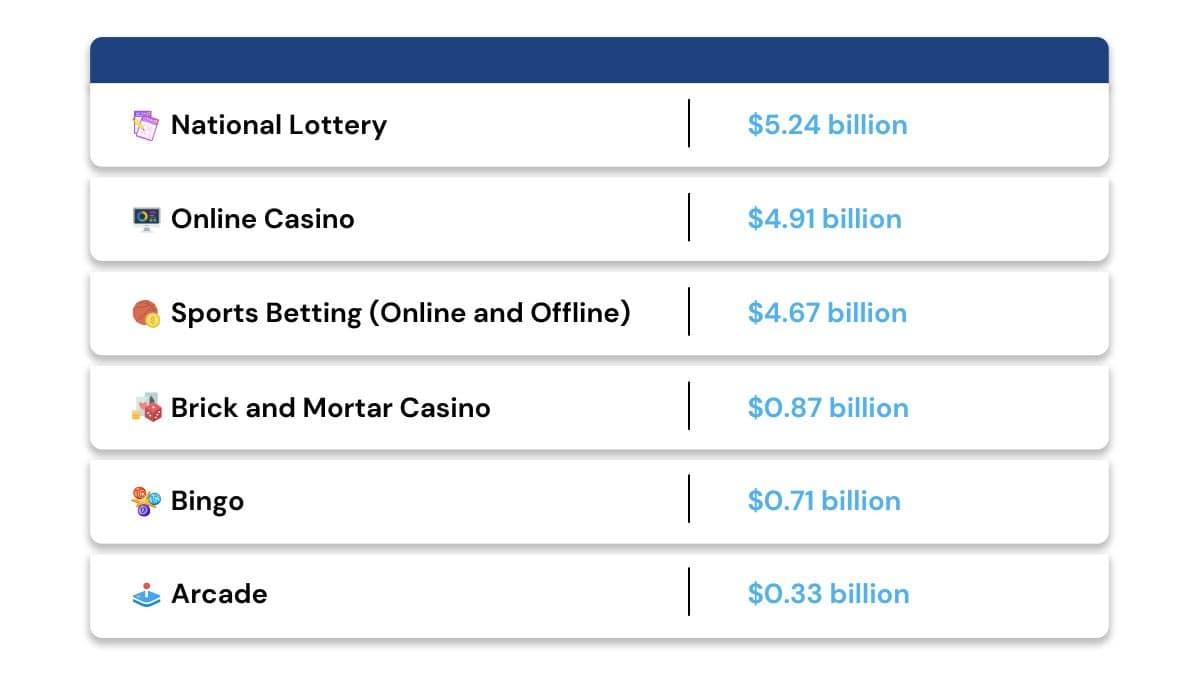

United Kingdom – The National Lottery

Though there has been a slight downward trajectory in casino participation over the last few years, Great Britain’s punters still made a respectable showing.

Unsurprisingly, bingo games are a massive draw in the UK, making up £388.6 million in Gross Gaming Yield — making it the UK’s fourth most profitable sector for operators, even with the number of bingo premises steadily declining since 2014.

According to UK gambling statistics, the most popular method of gambling was the National Lottery, which generated £8.1 billion between April 2021 and March 2022, a slight decline from the previous year’s £8.3 billion.

And while event (sports) betting and casino gambling (particularly slots) were still popular, they were easily overshadowed by online casino games and remote sports betting. £6.4 of the total £14.1 GGY were made up of online gaming options in 2022, with 32.65 million Brits signing up to play online slots, table games, and partake in the online sports betting market between April 2021 and March 2022.

Australia – Slots

Based on a gambling facts sheet released by the Australia Gaming Council (AGC) for the 2019/2020 year, roughly half of what was spent on gambling by Australians that year –$6.66 billion of the $13.87 billion overall — was spent on gaming machines, primarily consisting of slots.

After that $2.06 billion went into regular casino games, $1.71 billion into lotteries, and about $221 million split between other forms of casino games. This leaves $2.98 billion for race and sports betting during that year.

Online gambling is expected to make an annual growth of 5.22%, bringing it up from the projected $11.39 billion for 2024 to a high of $13.96 billion by 2028. As players made the move to online gambling to continue playing through the pandemic, more players stick around for the ease and convenience it offers, especially for sports betting enthusiasts.

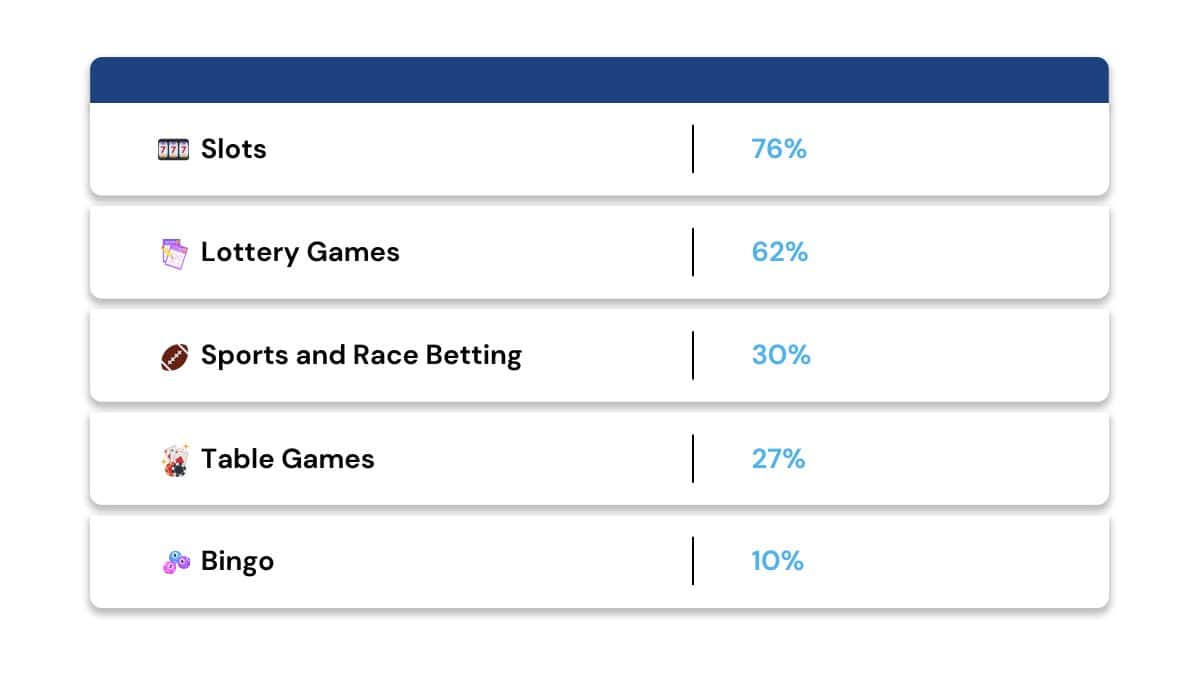

Canada – Slots

Changes to the laws in Canada saw a significant increase in online sports betting since these new laws permit gamblers to bet not just on individual games but elements within a game, making the sports betting market more appealing to a country that otherwise seemed disinterested.

As is usually the case, slot games make up the bulk of action at Canadian casinos with a participation rate of 76%, followed by 62% for lottery games, 30% for sports and race betting, 27% for skill games like poker and blackjack, and a strong (though not quite so strong as the UK) showing for bingo with a 10% participation rate.

The online gambling market in Canada is expected to reach $4.19 billion in 2024, with an annual growth rate of 6.84%, bringing the total up to $5.46 billion. This is in line with what we’ve seen in most of the other top countries, and with more and more young (tech-savvy) people getting into gambling, we expect to see more players adopting the online model, especially for sports wagering.

Singapore – Sports Betting

As with most of the Asia-Pacific market, online sports betting is the main thing behind the revenue. And with the popularity of esports in the region, it’s no surprise that betting on live esports events is catching on, especially as mobile online betting platforms get better at embracing this new betting market.

One of the more interesting facets of the Singapore gambling scene is that the majority of land-based gambling takes place in two integrated resorts.

The Marina Bay Sands and Resorts World Sentosa act not just as casinos but as tourist attractions themselves — contributing to the surprisingly massive GGR as players from around the world come to embrace a premier tourist experience.

Which Country Gambles The Most Per Capita?

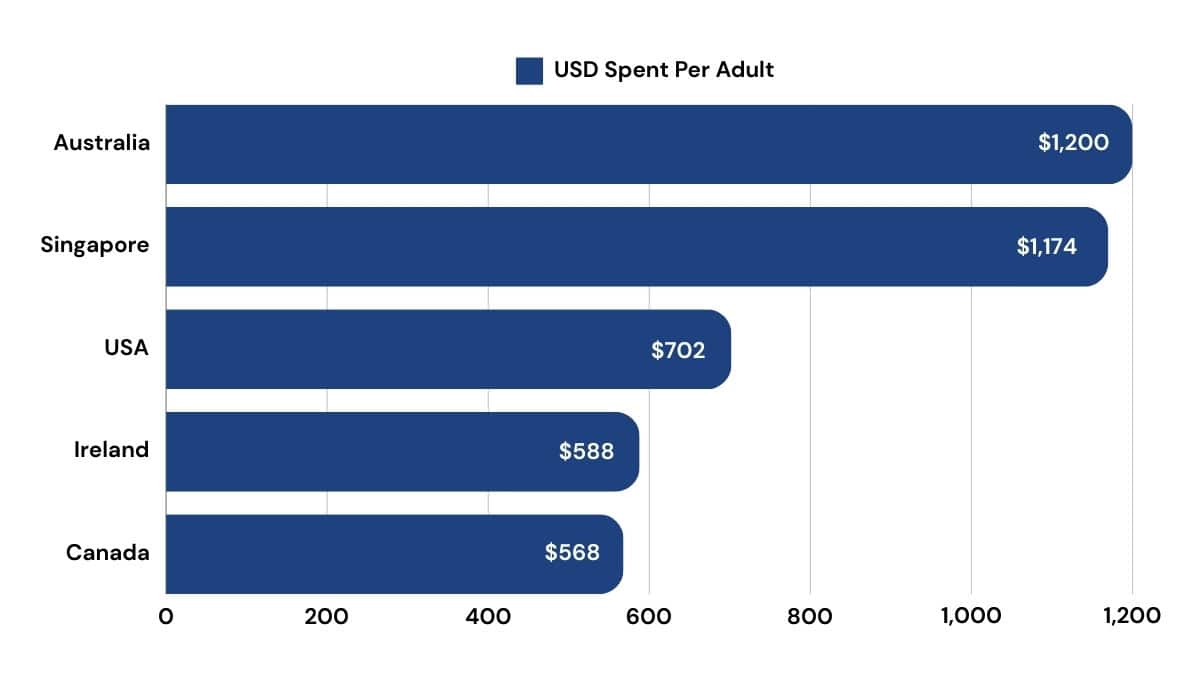

Australia: The per-capita gambling expenditure from one state to the next varies greatly, with the lowest being the island state of Tasmania at $393 and the highest being New South Wales at a whopping $984 per person back in 2019, though the average amount spent per adult in 2023 has shot up to an impressive $1,200.

Singapore: Coming in a close second is Singapore, spending $1,174 per adult.

USA: As legislation expands and gives US bettors greater access to gambling opportunities, we expect that the $702 per adult reported today is not going to increase drastically in the coming years.

Ireland: We were surprised to include Ireland on this list, but when crunching the numbers we found Ireland made up about 2.6% of all of Europe’s gambling revenue, spending $588 per adult.

Canada: Just behind Ireland, Canada’s robust betting industry brings in roughly $568 per adult and closes out our top five highest-spending countries per capita.

Gambling Worldwide – The Overall Number of Active Gamblers

| Country | Regular Gamblers | % of Population |

| Global Community | 2 billion | 26% |

| United States | 198 million | 60% |

| France | 29 million | 44% |

| United Kingdom | 29 million | 43% |

| Canada | 23 million | 60% |

| Australia | 9.7 million | 38% |

It is estimated that roughly 26% of the entire world regularly engages in some form of gambling, meaning over 2 billion adults are placing bets around the globe — though it is no surprise that some countries are pulling a little more than their share of weight.

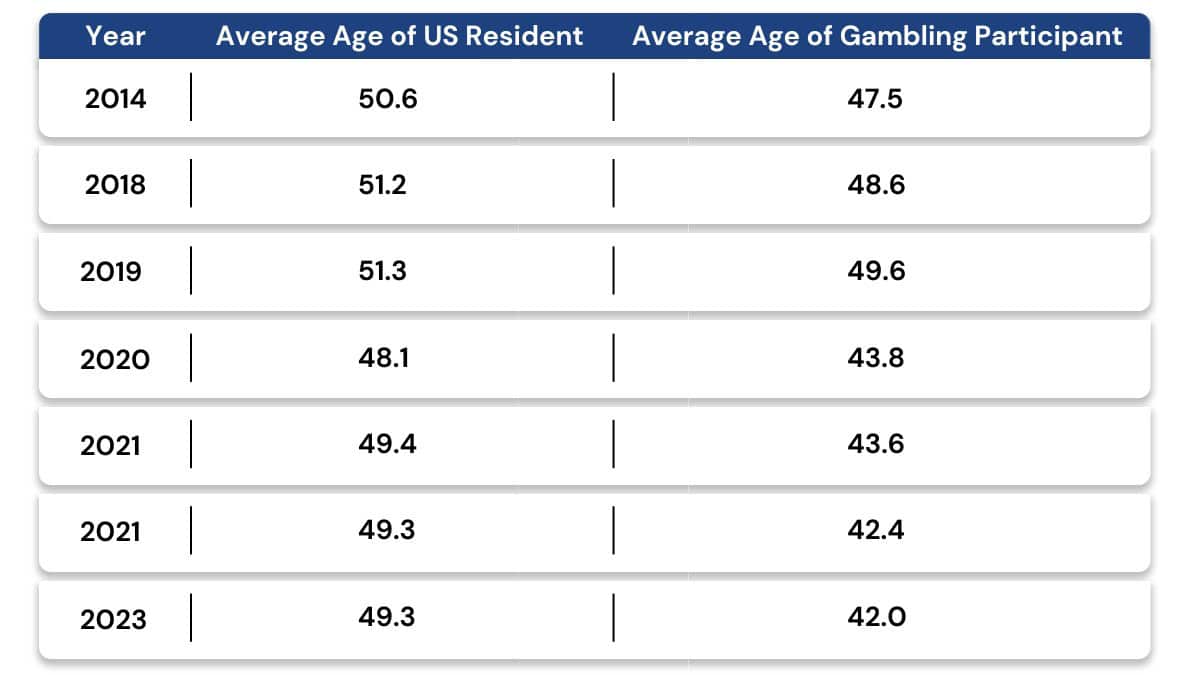

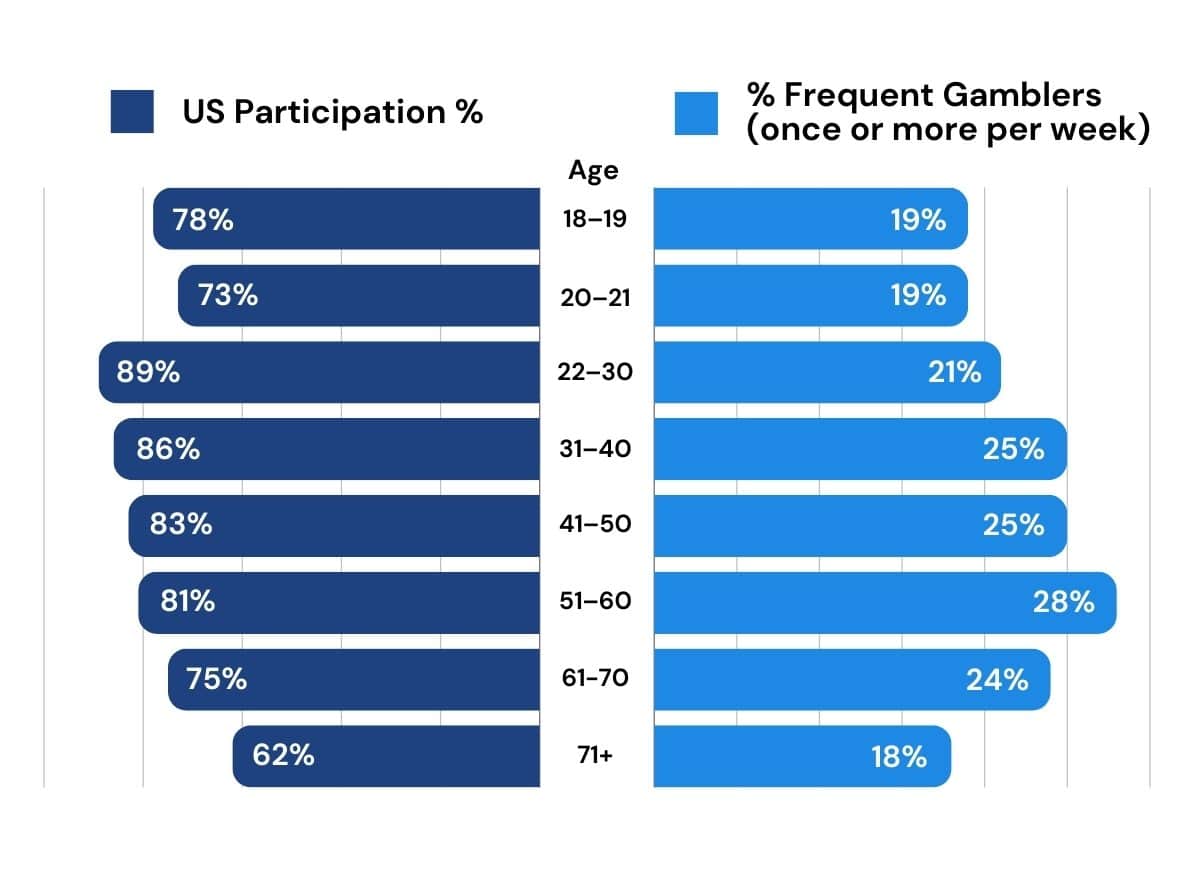

Gambling Participation By Age

While gambling has generally been regarded as a form of entertainment for more “mature” individuals (45+) there has been a significant increase in interest among the younger crowds, as evidenced by the latest demographic studies conducted in the United States. With so many younger players joining the scene, we have seen a drop in the average age of gamblers in the US for four consecutive years, even though the average age of residents has remained relatively unchanged.

Biggest Changes to the Global Face of Gambling

In the last few years, there have been a ton of sociological developments, legislative pushes, and technological advances that have shaped the gambling market we’re faced with today and given us insight into what we can expect to get out of it moving forward.

Here are a few of the more impactful line items.

Legalization of Sports Gambling in the United States

In 2018, the US Supreme Court overturned the Professional and Amateur Sports Protection Act (PAPSA) of 1992, opening the door for individual states to legalize sports betting, significantly expanding the gambling market in the country.

PAPSA was meant to define the legal status of sports betting throughout the US, and while it was in place, there were only a few states that could legally place wagers on sports. But now, over 5 years after it was overturned, 33 states plus Washington D.C. have legalized sports betting in some form with more pending legislation.

The Supreme Court opening these doors has caused a boom in sports betting, with more than $220 billion in legal sports wagers placed since 2018 — generating $3+ billion in tax revenue for the legalized states.

The UK’s Tightened Online Gambling Regulations

It’s no surprise that the ease with which players can access online betting sites is causing a stir — particularly in the heavier markets.

The UK has been introducing strict laws to regulate online stake limits, perform more identification and affordability checks (to protect players from spending more than they can afford to lose), and even give gambling regulators the power to take down illegal betting sites and unauthorized operators.

These regulations could also see even more restrictions on bonus offers like free spins and free bets, limiting some of the marketing tactics online casino operators rely on to get new players in the digital door.

Early estimates expect these regulations’ collective impact on remote (online) operators to range from an 8% to 14% reduction in GGY, suggesting a significantly reduced profitability and smaller market share.

New Demographics

In recent years, gambling has seen a dramatic increase in two key demographics: women and younger gamblers.

In studies done in both the UK and Canada, experts have found an increase in participation from women, with both groups finding that nearly half (42-43%) of women have gambled within the last four weeks.

Additionally, the American Gaming Association found that the average age of casino goers has consistently dropped over four consecutive years from 49.6 to 42 years of age. This implies that more and more young players are embracing online gambling at a rate significantly faster than those who are aging out.

The Rise of Online Gaming

The advent of mobile gaming and online casinos has dramatically transformed the market, making it possible to capture the portion of society that would not otherwise be interested in stepping foot in a traditional casino or bookmaker’s establishment.

Taking into account all forms of mobile and online gambling, this market is expected to reach a revenue of over $107 billion in 2024, with $23 billion of that coming from the United States alone.

This shift to personal technologies like desktop computers, tablets, and mobile phones has not only broadened the gambling market’s reach, attracting a younger, tech-savvy demographic, but also intensified competition between operators to offer more engaging, user-friendly mobile platforms.

The impact is a more dynamic, accessible, and diversified gambling landscape.

Exciting New Technologies

New technologies are emerging all the time, and any establishment looking to stay competitive is bound to find some way to integrate them to gain an edge.

We’ve already seen many online gambling sites take to and embrace cryptocurrencies and other blockchain technologies, including “Provably Fair” games. The bones of these games are built in such a way that the randomization for a given game can be checked and verified by any player.

Now that virtual reality games and hardware are becoming more commonplace, top minds in the industry are building and testing metaverse casinos to offer a truly immersive experience.

PokerStars — one of the biggest names in online poker — has taken a fairly successful stab at integrating the technology with their Vegas Infinite, though, as with all new technologies — it may take a while to catch on.

We are also already seeing AI popping up in the form of intelligent chatbots for customer support, though we can expect online casinos to leverage artificial intelligence to make game suggestions, create personally tailored bonuses and promotions based on an individual’s preferences, and more.

Key Takeaways

- 33 states have legalized online sports betting in the US to some degree, with more pending.

- The participation of women and younger people in online gambling has dramatically increased.

- The mobile gaming market is expected to grow to $107 billion in 2024.

- Poker Stars is the first gambling platform to make efforts to introduce VR technology into online gambling

Global Gambling Statistics – Conclusion

The gambling industry has proven that when faced with enough adversity, it has the innovation and gumption not just to weather the storm but find a way to thrive under any conditions.

Markets like the United States, the UK, Australia, Canada, Singapore, and many other countries all saw wild growth, creating a global market worth over half of a trillion dollars in 2023, and is expected to go well beyond that in the years to come.

We can’t wait to see how the industry evolves as new legislation is put forth, new technologies are developed, and new players sign on.

References:

Related

Best Crypto Casinos UK – Top 10 Bitcoin Gambling Sites…

Despite its overwhelming popularity, crypto gambling in the UK remains in a legal gray area. All casino operators in the UK need to have a valid permit, as requ

Online gambling channelisation in the UK – How well it…

Gambling in the UK is controlled under the Gambling Act 2005. This act requires all gambling operators to be licensed and regulated by the UK Gambling Commis

UK Gambling Commission Opens White Paper Public Feedback | Suffolk…

The UK Gambling Commission (UKGC) has initiated its third consultation period to gain feedback and proposals to make gambling machines in the UK more secure a

Paddy Power High Court case: Gardener wins £1m payout

Mrs Durber sued PPB Entertainment Limited, which trades as Paddy Power and Betfair, for breach of contract and for the rest of her winnings, based on what she w