Gedling council accountant stole £1m of taxpayers’ money

Nottinghamshire Police

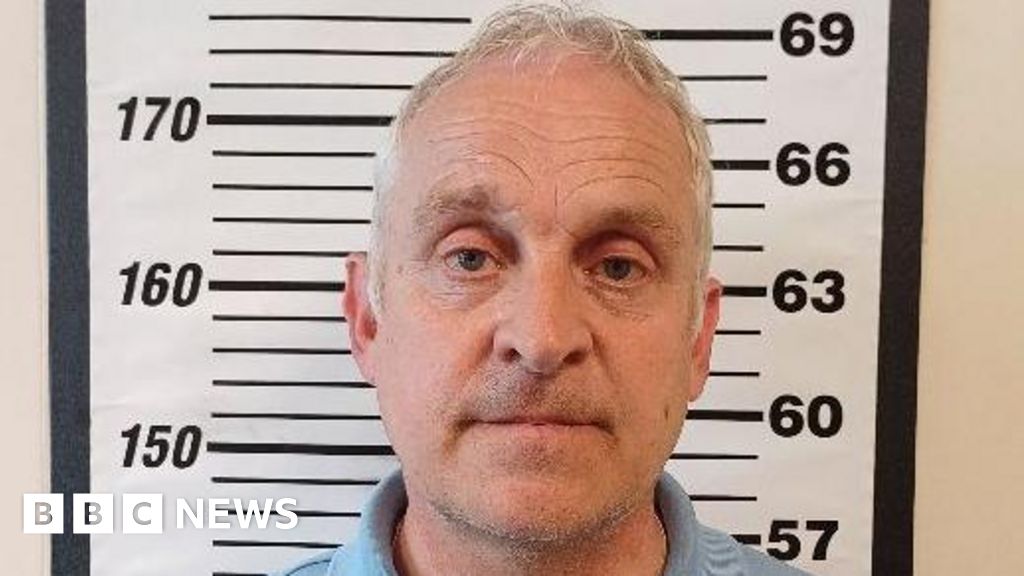

Nottinghamshire PoliceA senior accountant who stole nearly £1m of taxpayers’ money to fund his gambling addiction has been jailed for fraud.

Alan Doig helped himself to council cash at Gedling Borough Council in Nottinghamshire for nearly 20 years, covering up his deceit through a car loan scheme.

The 57-year-old was “relieved” when he was arrested, Nottingham Crown Court heard on Wednesday.

Appearing in court with a big black bag ready to be jailed, he was sentenced to five years in prison.

Google

GoogleThe court heard Doig joined the authority in 1985 as a clerical assistant and worked his way through the ranks, becoming a “popular and credible” employee.

He managed a team of staff with responsibility for payroll and creditor payments, as well as a car loan scheme, and used his knowledge of these systems to make illegal payments to himself over two decades.

His fraudulent activities were eventually uncovered when a member of his team noticed irregularities with the car loan scheme and raised concerns with a senior colleague, the court heard.

After he was dismissed from the authority in 2022, a more detailed investigation conducted by Nottinghamshire Police revealed the extent of his offending and uncovered 86 fraudulent payments totalling £934,343.30.

Doig had become a senior assistant accountant in the exchequer management section, where he remained until his dismissal as a result of his offences.

His work also covered the administration of payments made under the council’s car loan scheme, which allows employees to obtain a loan from the council to purchase a vehicle and repay it through deductions from salary.

But his understanding of financial systems meant he was able to divert funds without it being flagged as suspicious for many years, by raising fake invoices and credit notes, and moving money across different accounts.

‘You abused that’

The court heard Doig stole the equivalent of 6% of the council’s budget between 2004 and 2005.

Jailing the defendant, Judge Nirmal Shant KC said although the local authority had a significant budget, it was under pressure.

“You gained knowledge and expertise, but what you did with that knowledge and expertise, was to manipulate the system for your own gain,” she told Doig in the dock.

“You were in a position of trust and responsibility and you abused that.”

Prosecuting, Alan Murphy said Doig had been gambling since he was 17, initially at the horses or the casino, and he did not gamble anything he could not afford to.

“His problems had started after his wife had lost some money gambling and he had had to pay her debt,” he told the hearing.

“He had told her it was a waste of money but then created an online account of his own and won £12,000 on slots.

“From then on he described it ‘as a constant, every single night’. It was all he thought about, day in and day out.”

Mr Murphy said Doig opened multiple accounts to avoid betting company restrictions, and once he had used up his salary and savings, he “started committing fraud, chasing his losses”.

He said the defendant claimed he always paid his mortgage and bills, so his gambling monies came out of the rest of his income.

The gambling accounts had spending limits of between £1,000 and £5,000 per month, and so Doig had about 20 accounts, the court was told.

“He had been to Gamblers Anonymous twice, but in itself that hadn’t done anything to stop him gambling,” Mr Murphy said.

“He accepted that if he hadn’t been caught, he would have carried on, thinking he would have won all the money back.”

Doig, of Bedale Road in Daybrook, Nottinghamshire, pleaded guilty to obtaining money transfers by deception and fraud by abuse of position.

Google

GoogleThe council’s chief executive Mike Hill, whose victim impact statement was read in court, said after the sentencing: “Only someone with key insider knowledge could have done this, and we would not have been able to prevent this from happening.

“We had numerous checks and controls in place, we were subjected to regular and thorough audits of processes and procedures. It was only when legislation changes came in that required new checks, as well as his changes in behaviour, that the fraud was found.

“We are confident that this was an isolated incident by a man with a serious problem. He stole public money, which could have been used to pay for essential services, and we want to reassure the public that the money will be recuperated in full, and we have new systems in place to prevent this from happening in the future.

“We have a zero-tolerance approach to fraud and all of our staff are aware of this.”

Related

Best Crypto Casinos UK – Top 10 Bitcoin Gambling Sites…

Despite its overwhelming popularity, crypto gambling in the UK remains in a legal gray area. All casino operators in the UK need to have a valid permit, as requ

Online gambling channelisation in the UK – How well it…

Gambling in the UK is controlled under the Gambling Act 2005. This act requires all gambling operators to be licensed and regulated by the UK Gambling Commis

UK Gambling Commission Opens White Paper Public Feedback | Suffolk…

The UK Gambling Commission (UKGC) has initiated its third consultation period to gain feedback and proposals to make gambling machines in the UK more secure a

Paddy Power High Court case: Gardener wins £1m payout

Mrs Durber sued PPB Entertainment Limited, which trades as Paddy Power and Betfair, for breach of contract and for the rest of her winnings, based on what she w