What is the funding promised at Labour’s UK investment summit?

The government has said its first international investment summit since Labour’s general election landslide has secured a total of £63bn of pledges to plough money into the British economy.

The investments announced, which include the £63bn of private-sector promises as well as public investment, include:

-

£6.3bn on datacentres, including a £1.9bn datacentre campus at Didcot in Oxfordshire.

-

£21.7bn on carbon capture and storage, spread over 25 years. This public funding, announced in the run-up to the summit, is expected to leverage in £8bn of private sector investment.

-

£24bn on clean energy. This pledge, announced last week, will see Scottish Power’s Spanish owner, Iberdrola, double its green power investment over five years.

-

More than £3bn on transport infrastructure, including DP World investing up to £1bn in its London Gateway container port operation, after a controversial row with the transport secretary, Louise Haigh. Manchester Airports Group is investing more than £1.1bn in London Stansted airport.

-

£27.8bn in public investment, representing the total funds managed as Labour’s national wealth fund is merged with the existing UK Infrastructure Bank. The combined entity will be based in Leeds.

Related

Aecom secures positions on AMP8 UK water infrastructure frameworks

https://www.tipranks.com/news/the-fly/aecom-secures-positions-on-amp8-uk-water-infrastructure-frameworks Aecom (ACM) announced that it has achieved rec

UK reaffirms commitment to protect undersea infrastructure

In response to a parliamentary question from Earl Attlee regarding the UK’s readiness to address potential attacks on undersea telecommunications cables, the

How UK firms can revolutionise the GCC’s construction

Image credit: frimufilms/ Envato GCC countries are rapidly diversifying thei

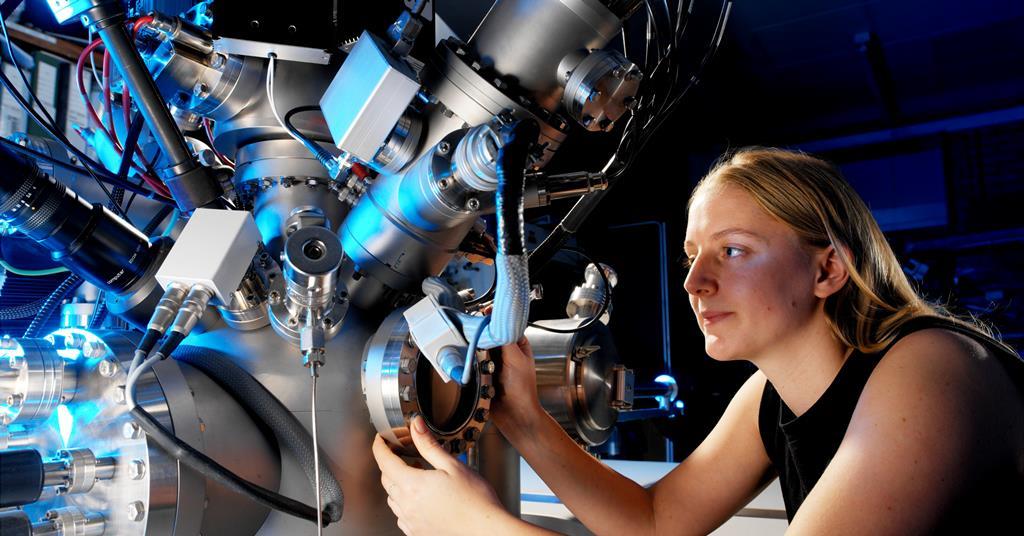

Research infrastructure programme delivering for UK higher education

The programme that funds higher education facilities in the UK is performing well, according to an interim report, and is successfully enhancing research infras