Gambling Commission 2023 survey flags in-person novelty betting as highest risk vertical

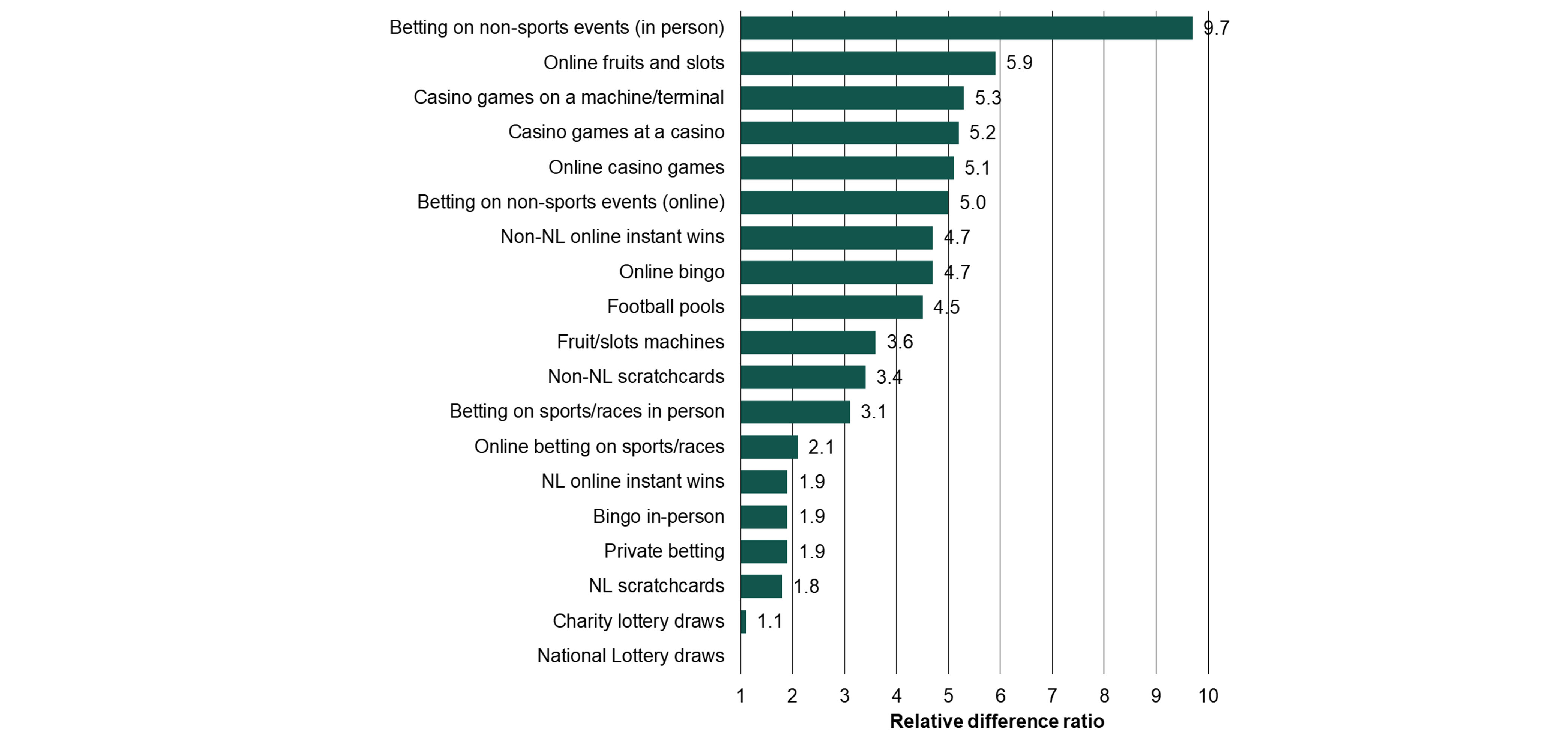

Players placing in person bets on novelty markets are nine times more likely to be a high-risk problem gambler compared to the average percentage of overall high-risk players across all verticals, the latest UKGC data has revealed.

In person betting on “non-sports events” represented the vertical with the highest average proportion of high-risk players (PGSI score of 8+), according to the UK Gambling Commission’s (UKGC) Gambling Survey for Great Britain, released today (25 July).

Comparatively, online bettors of novel markets were 5x more likely to be a high-risk player than the average.

For online slots, rates were nearly six times higher than average. Online sports bettors were less likely to be rated as a high risk than in person bettors. However, online casino users were more likely to be high-risk than retail casino goers.

The breakdown of data by vertical included data from survey participants who had gambled in the past 12 months.

New scoring system assesses problem gambling behaviours

The UKGC’s survey used a new scoring system called the Problem Gambling Severity Index (PGSI) to score those surveyed based on their problematic gambling behaviours

On the PGSI, a score of 0 represents a gambler who did not display any problem gambling behaviours. As the scale increases, so does the rate of adverse consequences experienced by players, based on a selection of nine behaviours.

Of those behaviours, chasing losses was the most common experience reported by participants (16%), while feeling guilty about betting and gambling more than you can afford represented 9.9% and 9.6% of the group.

Problem gambling increased in non-lottery group

Gamblers with no risk of problematic behaviours made up the majority of the surveyed group (85.6%), while 8.3% scored between 1 and 2 on the PGSI, representing low-risk gamblers. Beyond that, moderate-risk and problem gamblers accounted for 3.7% and 2.5% of the total group.

However, moderate-risk and high-risk gamblers grew to 8.3% and 5.9% in the non-lottery category, representing an uptick of almost 5% and 3% from the overall group.

Broken down by age, the 18- to 24-year-old group saw the highest quantity of problem gamblers by PGSI score (9.1%). The figure dropped slightly in the next age bracket to 8.4%, with the 55- to 64-year-old bracket having the lowest percentage of high-risk players (0.7%)

Overall participation in gambling higher among males

For overall gambling activities, 63% of males surveyed had gambled in the past 12 months, compared to 58% of females. Outside of lottery betting, 42% of males and 39% of females had gambled during the period.

By age, 25- to 34-year-olds had the highest participation of non-lottery gambling with 52% having gambled in the last 12 months. Of those aged 35-44, 50% had bet outside of the lottery. Participation then decreased with age, to 19% of those aged 75 years and above.

When looking at online gambling activities in the last month, the 18- to 44-year-old age bracket had the highest participation (20%-21%) when excluding the lottery. When taking the lottery into account, the 45- to 54-year-old bracket gambled the most online in the last four weeks (43%).

UKGC unveils new methodology

Overall, the survey was carried out by 9,787 participants. The returns breakdown showed that 64% (6,303) completed the survey online and 36% (3,484) by post.

The Commission had previously warned that the new “push-to-web” methodology meant results could not be directly comparable to prior gambling or health surveys.

It said in a guidance released last week that the survey should not be used to calculate an overall rate of gambling-related harm in Great Britain, or as a measure of addiction to gambling in the country.

As a result, the survey faced criticism even before it was published, with some stakeholders suggesting the methodology could overstate the level of risk within the gambling industry.

Related

Best Crypto Casinos UK – Top 10 Bitcoin Gambling Sites…

Despite its overwhelming popularity, crypto gambling in the UK remains in a legal gray area. All casino operators in the UK need to have a valid permit, as requ

Online gambling channelisation in the UK – How well it…

Gambling in the UK is controlled under the Gambling Act 2005. This act requires all gambling operators to be licensed and regulated by the UK Gambling Commis

UK Gambling Commission Opens White Paper Public Feedback | Suffolk…

The UK Gambling Commission (UKGC) has initiated its third consultation period to gain feedback and proposals to make gambling machines in the UK more secure a

Paddy Power High Court case: Gardener wins £1m payout

Mrs Durber sued PPB Entertainment Limited, which trades as Paddy Power and Betfair, for breach of contract and for the rest of her winnings, based on what she w